Her Majesty’s Revenue and Customs (HMRC) is the part of the UK Government that is responsible for the collection of taxes, state-support, national minimum wage and the issuance of national insurance numbers.

Sadly HMRC is not known for their simplicity but is known for issuing various tax forms to us throughout our working lives, and it can be quite tricky to understand their use and how they differ from one another. The two most commonly used forms are the P45 and the P60. This post will help to outline the main differences between the two, along with another relevant form, the P11D.

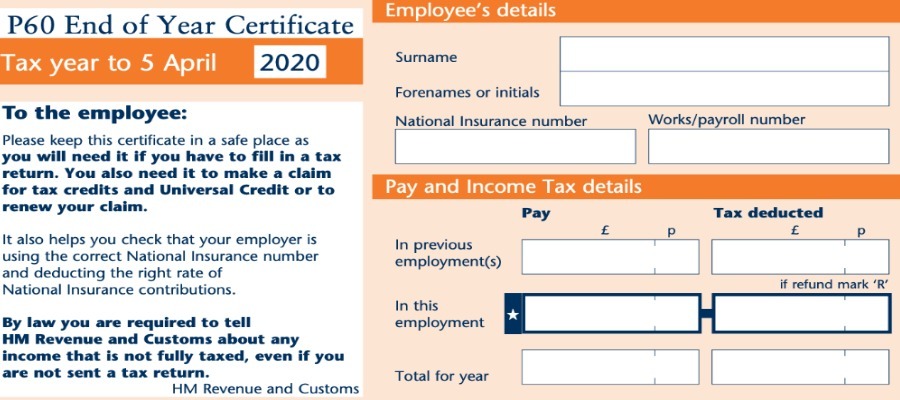

What is A P60

Your P60 outlines your overall pay for the year (any relevant pension contributions deducted) along with the tax that you have paid in the given tax year. Your employer, or employers (if you have more than one job, you’ll get a P60 for each) must issue your P60 to you after the tax year ends (April 5th) and by May 31st. The employer must abide by the timescale to ensure that you can complete any relevant tax return documentation, if required. If you’re in the position where you have left a job during the tax year, your necessary tax information will be found on your P45 rather than your P60. We have discussed the P60 below.

Why Do You Need A P60

Its important that you keep your P60’s in safe place as they will be used in a range of tax related situations such as;

- Filing you Tax Return – You will need this especially if you’re self-employed as it’s a vital document that shows how much tax you should be paying each year.

- Tax Credit – such as how many national insurance contributions you have paid.

- Tax Rebate – have you paid to much?

- Mortgage – To get a mortgage, you’ll need a

How Can I Get A Copy Of My P60

As discussed above, your employer will give you a P60 at the end of each financial year. If you think its wrong, you can either take this up with your employer, or with HMRC directly. If you have lost your P60, dont worry, your employer is legally required to keep your P60 for three years, afterwhich you can either ask your employer for a statement of earnings, or you can contact HMRC who will be able to help. That all said, it much easier to keep your P60 in safe place, where you can store it for the future.

P45

A P45 is the document which your employer is legally obliged to issue to you when you cease working for them. The P45 will outline the amount of tax and National Insurance Contributions that you have paid to date that tax year (6 April – 5 April) through the salary that your employer has paid you.

When is it required?

The P45 will be requested upon new employment and may also be required when seeking to claim any tax refunds or benefits. A P45 comes in four parts. Parts 1A, 2 and 3 will be given to you whilst the employer that you are leaving will send Part 1 to HMRC.

Your new employer will request Parts 2 and 3 upon commencing your new job and Part 1A is for your own personal records.

P11D

Last but not least, is the P11D form. If you are fortunate enough to receive any ‘benefits in kind’ (think interest free-loan, company mobile phone, car and so forth), this form will outline the details of said benefits and how much they are worth.

Your employer can calculate and deduct any relevant tax for your’ benefits in kind’ from your pay. Depending on how they have calculated and reported your benefits, you may or may not receive a copy of your P11D form. You should discuss this with your employer.

Final Thoughts

As with all important documentation, it is good practice to keep your issued tax forms in a safe storage place to ensure that they are readily available and accessible should they ever be required in the future.