I’m not a millionaire, I don’t have a huge salary, in fact I’ve never made more than £50K in year, and neither does my wife, she earns about £37K year. We’ve also got two kids, a dog, a mortgage, a car loan and have two decent holidays, as a family each year. We live well, but we also save for that day in the future when we can become financial independent. Today I have to work, I have to earn money to support my family, but, this not always going to be the way. There will come a point in the future, where I can become financial independent and make my choices to what I do, and what don’t do with my time. This is how I’m going to retire a millionaire my the time I’m 50.

Who Am I?

My name is David, I’m 39 years old, married with two kids (4 & 2), we live in a four bedroom semi-detached house just outside London. I work in finance and my wife works in marketing. We are your typical middle-class family in southern England, with one key difference, we’re going to become financial independent aged 50.

How? We’re going to earn money with multiple income streams, while saving money each month, which will be invested, and through the power of compound interest, grown over time. For me it all started in September 2003, when as a 23 kid, I left University and started my career in finance.

A Million Pounds

To say that you’ve retired age fifty with a million pounds in your bank account is the dream of many students that leave school to start in their career. Remember, just because you aim to have a million pounds in your bank account, doesn’t mean the only way to achieve this goal is by having one massive paycheck, or even a large salary. Many people have achieved this goal by naturally growing their income, saving and investing it over the long term.

One point we should make early on, other than the bank of Mum & Dad, there are no shortcuts. You’ll need to focus on a few critical areas in both your career and your home life, but if you follow some essential advice, building a bank account of a million pounds, is not very difficult. Here’s what you need to do;

Your 20’s

In your 20’s, you need to focus on three areas. Your career, income streams, and paying off any high-interest debt that you’ve accumulated during your education. If you’re anything like me, you’ll have a student loan, an overdraft and possibly a bank loan.

While you’re studying, all of these are interest-free; however, once you’ve left University, the charges start to mount up quickly. My overdraft went from being interest-free to over 18% per year. The smart move is the pay off these loans as fast as possible, but also to manage the interest rates. There is no point in paying 18% for an overdraft when you could take out a personal loan and pay 4%.

Career

Your career is critical and these early years, especially so. The idea is that you need to become an “Expert” in your field. By becoming an expert in your field, you’ll guarantee that later in life, your earnings will be significant.

Remember, you’ll be paid more if you’re an expert in your field, than if not. Your 20’s are the time when you develop the skills needed to become an expert later in life. Your 20’s is also the likely to be the last time in your life when you’re likely to have spare time during the week and are therefore a great time to get your qualifications completed for later in life.

Qualifications are generally the basis to a successful career. Your 20’s are the best time to these done. As an example, if you want to work in Finance in the UK, you’ll need to get your ACCA, ACA or possibly your CPA completed. These qualifications are not easy, an ACA is fifteen exams probably over three years, but once complete, you’ll be a recognised financial accountant and well on your way to becoming a financial expert in your field. If you don’t have these basic qualifications, it’s much more difficult to be recognised a financial expert in your field.

In terms of salary, qualifications reflect earnings. In London, a non-qualified Accountant earns an average of £24000, while a newly-qualified ACCA’s salary is around £42k, and with a few years of experience is jumps to above £50,000.

Pay Debts

Initially, any savings should be going towards pay off your educational debt, starting with the high-interest debts first. Low-interest debt is not such a concern and will require a decision to be made on whether you invest, or pay this debt.

On a personal basis, when I left University, I had a large student loan, but the interest was minimal and only required me to pay 9% of my income towards my student loan. More importantly was the £10,000 that I had on a credit card that was interest-free while I was studying, but I was now being charged 19.9%, the £7,000 I had a on an overdraft in a similar situation and a few other different loans that I had all now suddenly started requiring interest payments.

I did two things to mitigate these problems. Firstly a £25,000 personal loan, at 4% a year , over 5 years took care of the majority of my debts and allowed me to simply pay a monthly bill of around £450 each month. The extra money also gave me a little piece of mind that I had some money for accommodation and food during those early months when I started my career. I also budgeted my spending and made serious sacrifices to save money.

Saving Money

The crucial second focus during your 20’s needs to be saving as much as you can. As an absolute minimum, you need to be saving 20% of your income, however, this can be taken the extremes – The FIRE retirement program.

Your 20’s are a great time to save money and start those retirement plans. It’s one of the very few times in life when you have minimal expenses. Financial advisors typically recommend that you take 20% of your salary and transfer it directly into your savings. Ideally, this should happen automatically. This way, you train yourself to live a conservative lifestyle and begin your savings for the future.

Most people I meet don’t save money in their 20’s. The usual response is that they cannot save due to debts from school or University, and they don’t earn enough to cover their expenses and save money. As a financial advisor who also paid his own way through University and started his career with a selection of debts, I understand this, but I also feel there are plenty of way to enjoy your life while saving money in the process.

Pensions – Free Money

Make sure you take advantage of any pension schemes that your offered along your career. You probably cannot access them until your 55 at the earliest, and while growth rates are not huge, in many cases you’ll be able to take advantage of what I call free money.

- State Pension – You need 35 years of contributions for a full state pension in the UK today, and you cannot have it until your 68 years old. Not much good if I want to retire aged 50, but worth paying into and thinking about. Remember, you only need ten years of half a state pension and even if you’re missing a few, its possible to back-date payments.

- Company Pensions – In the UK its a legal requirement that your company provides a work place pension of you’re older that 22 and earn more than £10,000 a year. The legal minimum that must be paid into your pension is 8% of your salary each year, with at least 3% being paid by your employer and 5% by the employee. In my case, my total contribution is £340 per month, of which I pay £170, the tax-man pays £42.50 as my tax relief credit and my employer pays £127.50. Much like the state pension, I cannot access this until I’m 57 years old (currently 55, but changes to 57 in 2028), and even then, it’s not going to give me more than £500 per month income.

- Free Money – My employer adds 3% or £1,530 per year to my pension. It’s not a huge amount, but its what I call free money and it not always 3%. I have a friend who works for an advertising company who match his contributions up to 10% of his salary. This is what I call free money and worth having.

Financial Advisers

I’m a great fan of self-investing. Personally, the damage that a financial advisor does by charging fee’s does not outweigh the mistake you’ll likely make, by investing yourself. If you meet with a financial advisor and sign up for a self-invested retirement plan, you’ll likely pay 1.5% annual management fee for the plan and another 1% to the financial advisor.

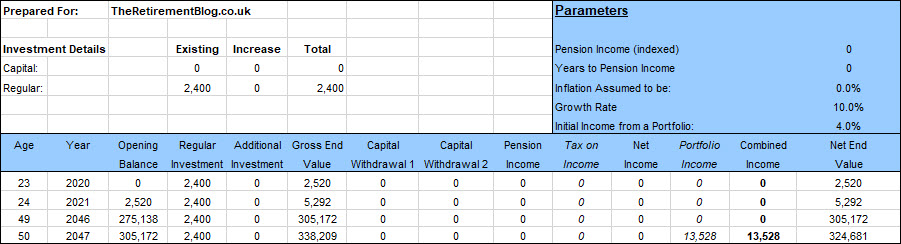

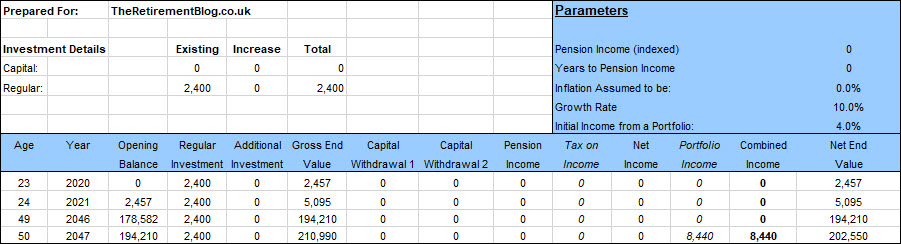

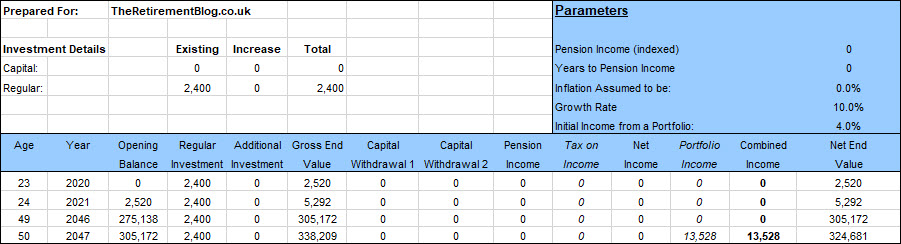

If we use the above example and imagine you’ve invested £200 per month, from the age of 23 to 50 years old, you should have £338,209 in your investment account as shown in the table above. If you’ve used a financial advisor and you’re paying 2.5% for the pleasure, that same investment would only grow to £210,990 a shown in the table below. The financial advisor would have cost you a massive £127 219 over the 27 years.

Invest Your Savings

Once you’ve paid the debts, next, you need to start building your savings and start creating wealth. Remember, becoming a millionaire is not going to happen overnight and require years of regular savings and compound interest.

In your 20’s is the time to take risks on the stock-market. This doesn’t mean that you should be going out and borrowing money to invest, but taking the additional risk by buying the latest IPO is not going to hurt you in the long term.

In an ideal world, you should be looking to generate a return of 10-15% on your money. If you saved £200 per month from the age of 23 to the age of 50 (i.e. 27 years), with compound interest and an interest rate of 10% (which is very achievable), you’d end up with £338,209 by your 50 birthday, Increase that to 15% and you’ll have £843,929.

Where to Invest

Of the people I speak with that have savings in their 20’s, the number of those people who invest their savings, is in the single digits. The general response is that they don’t know how to invest or they feel they are simply going to loose there money. The problem, none of this could be further from the truth. Its very easy to set up a savings account and choosing shares to buy is as easy as pressing a couple of buttons on your computer.

That all said, you do have choose the right platform and watch out for your costs. I have friends that have set up a simple trading account and buy stock each month. The problem with this, if they make profit on their shares, there could be a tax liability. Secondly, brokers will charge a fee to enter and exit a trade.

As example, my favorite broker in the UK Hargreaves Lansdown will charge you £11.95 to enter a trade, and the same to exit. This is not a problem if you’re buying £25k, of a specific company stock, but if you’re only buying £100’s, a £11.95 charge means you need to make nearly 12% before you even make any money. The way around this, you buy through an ISA, using a platform provided by Hargreaves Lansdown – you can read more about that process here.

Income Steams

To generate wealth, you need to build more than one income stream. Across this website, we talk about creating multiple streams of income. The idea here is that multiple streams of income will generate free cash flow that can be used to pay debts, and add to savings leading to increased compound growth of your investment.

Personally I had no money, the first few years of my twenty’s were spent paying off debt and trying to get myself back zero. My side-income was very important as it allowed me to pay off my debts faster, but also have some spending money. Personally I had three key side incomes to make extra income, but the list of side-jobs is endless. My three side incomes included;

- Freelancing – I worked as a freelancer doing other people’s accounts or basic financial accounting. I would charge something in the region of £10 per hour, I would work around three hours a day, plus the weekend. I use websites such as Freelancer, Upwork and peopleperhour to find work and while the work was mundane and very boring, I made an extra £500 per month.

- Blogging and Website Building – When I first started blogging back to 2007, it was a hobby that I thought I could make some money with, but I did not know how. I had just read an article from ShoeMoney where he holds up a cheque from Google for $132,994 and I thought I could do the same. In real terms, I made nothing for years, despite putting in thousands of hours of work. Over the last 13 years that I’ve been blogging, I’ve built twenty sites including this site. A few were successful, most were a terrible waste of time and money. That said, if it was not for blogging, I would never have paid the deposit on my house.

- StockMarket – Thirdly I played the stockmarket. As you will have noticed, I’m an accountant by day, and a personal finance adviser by night. I love the stockmarket and love my numbers. The stockmarket is what joins everything together. It what takes me, as lets be honest, an average accountant, and makes me a multi-millionaire.

Your 20’s is the best time to put this plan into action. What side gig’s could you do?

30’s

Your 30’s is typically when life becomes a little more complicated. If you’ve concentrated on your career, you should have been promoted into middle management, and your salary should’ve started to increase.

The bad news, your 30’s is also the time when you need to raise cash for the deposit on your first house, pay for a wedding and start paying for children. Typically, this is the decade when life starts to get more expensive, and your finances begin to be put under strain. It’s important to remember your saving for the future.

The Damage You Could Do

If you’ve been saving for the last few years and have a small investment portfolio, this is not the time to dive in and use it for that one-off bill. Yes, weddings are expensive, but your saving for your future and to one day have a million pounds in your bank account. If age 30 you decide to spend your savings on a wedding, for example, and must start from scratch with your savings, the effect is scary.

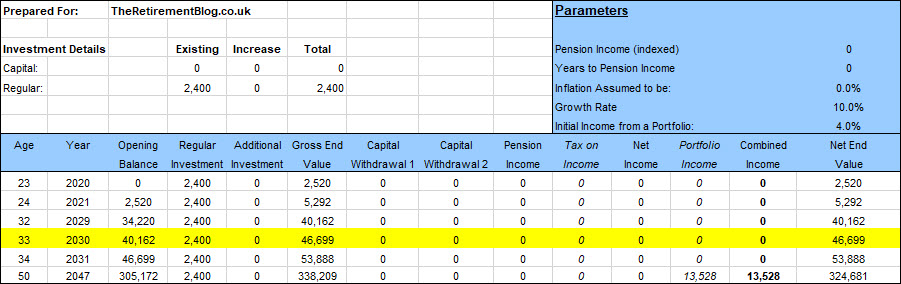

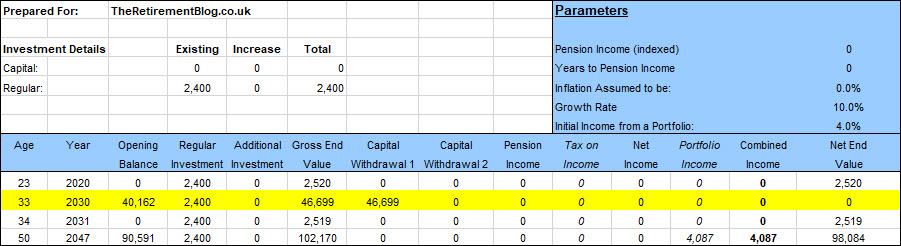

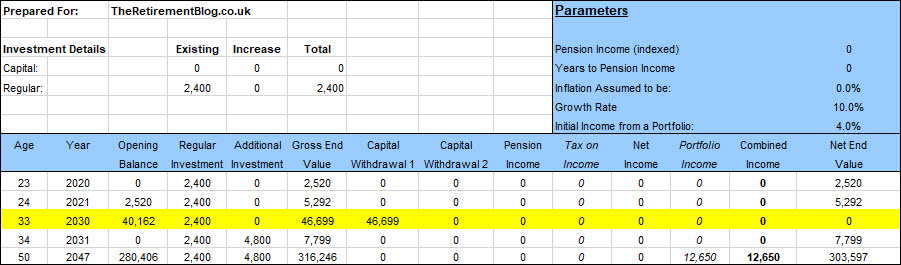

If you saved £200 per month between the age of 23 and 50 (i.e. 27 years), with compound interest and an interest rate of 10% (which is very achievable), you’d end up with £338,209 by your 50 birthday. If aged 33, you decided you wanted to liquidate your retirement portfolio, you’d be able to take out £46,699 (as shown below). However, the damage you’ve done to your retirement portfolio will be detrimental to your future.

Your portfolio will now start from zero. The £200 per month that your investing will now only become £102,170, by the end of your 50th year. .

Worse still, if you want to take it to the £338,209 with the same 10% return, you’ll either need to carry on working until your 65 years old (another fifteen years) or triple your monthly premium to over £600 per month to even get close.

Living Below Your Means

In your 30’s, people tend to start making more money. If you’re getting married, you can now look at the total of two incomes, now that you have two earners in the family. This often means that people start living way above their means and enjoying the lifestyle they’ve created. If you want to become a millionaire, rather than living the life with your now improved finances, you need to make sure you’re saving this disposable income.

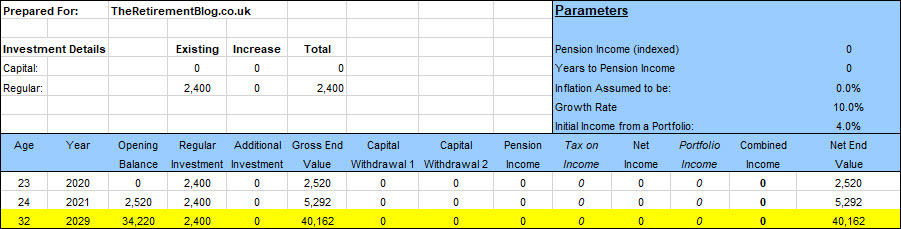

If you’ve been saving £200 per month between the ages of 23 and 32 (ten years of investment), and it’s grown by 10% per year, you should now have savings pot of £40,162.

With your promotions, your dual income, you should easily be able to increase this to £500 per month. The effect is massive, now by the end of your 50th year, you should now have £518,782 in your savings account. If you used the 4% rule, this would mean a Gross Income of over £20,000 per year for the rest of your life.

If you can increase this number further to say £750 per month, it means that at the end your 50th year, you’ll have £669,259 in your savings account and if you invested £1,000 per month, you’ll have £819,736 in your bank account.

Side Gigs

Remember those side-gigs that you started in your 20’s. If you’ve kept at it, and made it work, not only will you have an income, but you could also have an asset that’s worth something.

On a personal basis, I’ve all but stopped the freelancing as I simply don’t think it worth my time. Family life has taken over, and what free time I do have, I think is better spend elsewhere. I have kept going my blogging given there are numerous ways to make money from blogging. Currently I make a solid income every month from blogging, however the real value is selling those websites.

In 2010 I got married. We had help from all sides to pay for the wedding, however the real expense was the house a I bought in 2013 for £450,000. I put down 20%, nearly £90,000 and took a £350,000 mortgage using both mine and my wife’s combined salary. Where did I get £90K from? Those websites that I spent many late evenings and weekends working on were actually worth the time an effort. I got 32 times the monthly income for two sites, which after tax left me with just over £100k.

Maximise Employer Contributions

In the UK from the age of 22, if you’re earning over £10,000, you’ll be enrolled into a workplace pension scheme to start saving for retirement. Currently, 8% of your total monthly salary will be put towards your retirement – 5% of your salary and 3% matched by the employer.

Remember, that 3% match by the employer is free money and potentially it could be much higher. Often companies will match your contributions to an upper limit. If this is the case, make sure you take advantage of it.

Tax Mitigation

It’s essential to make sure you aware and taking advantage of any tax-free saving plans you have access to. In the UK as it stands today in 2020, you’ll pay no tax on the first £12,500, 20% on any income between £12,501 to £50,000, 40% on £50,001 to £150,000 and 45% on anything over £150,001.

The problem comes if you’re running a self-invested pension scheme and are 15 years into saving your £400 per month. You’ll have some where in the region of £180K. If 2020 is anything like 2017 and returned 15%, you’d have made close to £27K which could easily put you into the 40% tax bracket. Imagine loosing 40% of your hard earned profit.

The UK has three tax-free saving plans that you need to take advantage of. Cash ISAS that allow you to save upto £20K with no income tax, Stocks and shares ISAS which has the same 20K and no income tax, and a Lifetime ISA that is a longer-term tax-free savings account where you can save up to £4,000 per year (excluding a government bonus of 25% up to £1,000) depending on your tax rate. Its income tax-free, however, it’s designed so that you cannot access your money until you hit 60 years old.

Debt

You’re early 30’s is typically when you start building your debt. I bought my first house in my thirties. Most of my friends did the same. Firstly, make sure you get your sums right when you start taking out debt. I’ve had to organise loans for a lot of clients over the years who’ve spent the maximum they were allowed on a mortgage, but forget about the cost to buy, property alterations and new furniture expenses.

You also need to focus on how much your mortgage is going to cost over the years. Often people are lured in by the flashy super-low introductory rate, only to find out it suddenly disappears, and the new rate is not competitive and worse still, there’s a price to change to a different company. Get a mortgage wrong, and it could end up costing you thousands of pounds over the years.

40’s

Typically, three things happen in your 40’s. You get close to your peak earnings, children start to make a dent in your monthly expenditure, and for the majority of us, you begin to think about your future more seriously.

Nothing Saved

One point to make early on, I hope you’ve taken the advice above and started saving for your retirement. If you haven’t and are one of the 25% of adults over the age of 40 who has no savings, don’t worry. It’s not impossible to retire a millionaire, but you might have to delay your retirement for a few years.

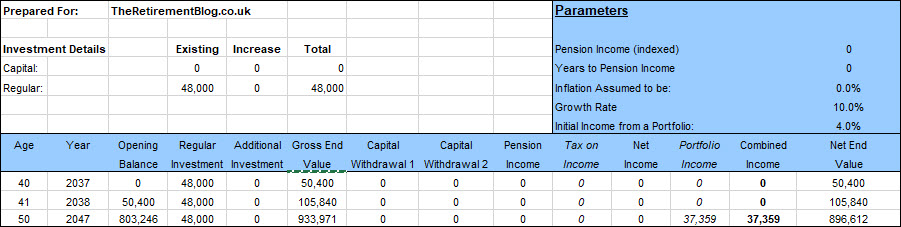

If you saved £48,000 per year and it grew by 10% each year between the age of 40 and 50, you’d end up with a pension pot of £933,971. Using the 4% rule, this would provide an income of £37,359 per year. Realistically, this is not possible and either you need to delay your retirement until the age of 55 or even later. If you saved £2,500 per month for fifteen years, you’d have £1,000,833, while if you delayed your retirement until the age of 65, you could save just £800 per month and still retire a millionaire.

Career

Your 40’s should be your peak earnings where you earn the most throughout your career. Most people assume it’s their 50’s where they’ll make the most, but very often this is not the case. The problem with careers when you’e in your 50’s is that they cannot be relied upon. If you get laid off age 55, do you really think you’re getting another position?

The problem in your 40’s is that you’ll earn the most, but you’ll also spend the most. Children start to get expensive, and typically there is more pull on your finances to spend on holidays. The important thing in your 40’s is not to overspend. You need to keep your finances in check and make sure you’re saving towards your future.

Retirement

Your early 40’s is your last chance to think hard about your retirement and make sure you’re heading along the right path. I hope you’ve been saving for your future and have a good start towards your retirement pot. That said, if you haven’t, now’s the time to get serious.

I’m a great fan of not paying financial advisors for advice in the early years where you’re trying to grow assets. I feel that if you can follow some fundamental information, and stick to it, the benefits of using a financial advisor, do not make sense. That said, in your 40’s, it’s worth seeing a financial advisor to make sure you’re on the right track with your retirement plans. There’s no point saving all this money towards your retirement, only to find out that you got your maths wrong and your £500K short.

Personally, my pension pot needs to be £1,540,000 for me to live comfortably for the rest of my life. I have worked this amount out as follows;

- Step One – The first question you need to think about is your “years to retirement”. I’m 39 now, and I want to retire aged 50 – 11 years to go.

- Step Two – How much money do you need to keep your lifestyle the same in retirement as you would want to have. For me, I need to have £3,000 per month spending money each month.

- Step Three – Add inflation. With UK inflation being around 2% for the last 25 years, adding 2% compounded for the next 11 years, means that actually I need £3,730 in 2030 when I come to retire.

- Step Four – What’s the tax rate? Sadly we don’t know what the tax rate will be in 11 years, but we can have an educated guess based on today’s tax rate. In this example, we’ll need a monthly income of £3,3730 (£44,760 per year). Grossing this figure upwards to include tax, we need a Gross Income of £57,606 a year. (£57,606 Gross – We will get £12,000 tax-free, and the remaining £45,106 would be taxed with a basic income tax of 20% leaving £32,760).

- Step Five – Calculate the size of your pension pot using the 4% rule. For £57,606 per year, I’d need a £1,440,000 pension pot at the age of 50.

- Step Six – Add the cost of a property as you need somewhere to live. I have not added this on, as I will have my house paid by the time I retire.

- Step Seven – Add on an amount for your bucket list. I’m adding on £100,000 for my bucket list items.

Insurance

I would also be asking financial advisors about insurance and what you need to protect yourself and your family. You need to make sure you’ve got adequate health insurance, life insurance and disability insurance to cover both you and your family.

The road to a millionaire is likely to be for you and your family. If you’re the primary bread earner and something happens to you, you need to make sure that road does not stop. If you have children, I would make sure you have term life insurance and disability insurance for the duration of the time that your dependents will rely on you financially. This way, as long as you pay the premiums, you’re covered if anything happens to you.

NOTE – Make sure you have a will.

Investments

Your 40’s need to be about maximising your savings and investments. In the UK, you’re allowed a maximum of £20,000 per year into your stocks & shares ISA. If you can save more than £20K each year, you can invest through a direct share platform, or potentially a SIPS (self-invested pension scheme), but remember, if you add money to a SIPS, you won’t be able to touch it until your 57 years old.

Your 40’s, is not the time to up the risk factor on your investments. Yes you could make a higher return, but you could also loose a substantial lot more. In your twenties, you can take a major risk on emerging markets or the latest IPO, knowing that if it goes wrong, you have time to recover. In your forties, this is not the case.

A 30% loss in your investment portfolio could easily mean an extra five years working while you try and make up for the loss.

The Wife’s Side Gigs

In your 30’s when the children are young, you either have a choice of asking one parent to stay at home to look after the children, or you both work and pay for childcare. Often, it’s the wife who loses their career for the sake of the children.

In the early years, this is no problem. Looking after two children under six is a handful. The problem comes when the children go to school, leaving the wife at home with nothing to do. There are options to go back to study and re-train. There are also those side-gigs that you’ve been working on throughout your life that could come into play. If you don’t have a side-gig, check this blog post out where we look at 100 ways to make money.

If you do, now’s the time to pass it over the wife. She can work at home, building out what you started.

How Am I Doing?

Personally, I have 11 years left to retirement and in all honesty, I’m not in a terrible place. Remember, our combined incomes are not more than £100K and year, with two kids in school, a mortgage and a few other loans, I do my best to save £500 per month, while topping this up with bonus’s and extra earnings along the way.

You can check out my here, and how we as a family budget our spending here, but in short, my finances are the following;

- Property – I bought the family house in 2013 for £440K, using a £90K down-payment and a £350K mortgage. I’m seven years into a 25 year repayment plan with about £220,000 left of mortgage. I expect to pay off another £180,000 over the next 11 years, leaving around £40K on a mortgage at retirement. House prices continue to rise in the UK and with my house now worth £600K, I’d expect to sell it for closer to 700K when I retire. Yes I have buy somewhere to retire, but it wont be a £700K house just outside London.

- State Pension – At retirement, I will have 27 years of state pension contributions giving me a proportionate pension. Given there is the option to pay up the remaining seven years, I will probably do this as it’s worth around 10K a year. Sarah will also get a state pension for her contributions and while she has not worked the full 35 years, she will easily get half, another £5K a year.

- Work Pension – I’ve been paying into a company pension for the last 16 years and will pay into it for another 11 until I’m 50, but I’m unlikely to access this until I’m 60. By law, you can currently take your workplace pension at 55, but this will increase to 57 in 2028. By my calculations, my workplace pension should allow for £24,000 per year in Gross Income if I don’t touch it until the age of 60.

- ISA and Other Investments – You can see my investments here, but realistically I’m on target to have a pension pot of about £1,200,000 by the the time I’m 50. If I can take out 300K from my house, I will meet my pension targets aged aged 50 of £1,540,000.

50’s

I want to be out of the corporate environment by the time I’m 50. It doesn’t mean that I’m never going to work again, but what it does mean, I won’t be working for someone else. I will be in that finanical positon where I can choose what projects to take on and more importantly, what projects to leave alone.

If you’re planning to work into your 50’s and potentially 60’s, this time of life should be your peak earnings, however all too often, we’ve met clients who have been laid off due to their company downsizing or a recession and find it very difficult to get back into gainful employment. If you’re still in gain full employment, enjoy it while it lasts. Sadly age discrimination is a real thing and in your late 50’s you’re likely to be discriminated against. Worst still, it’s also complicated to get a new job as companies feel that you will not be able to add value to their young, dynamic company.

Retirement

If you’ve taken on board the advice above, you could be very close to having the option to retire or at the very least, choose whether you want to work. If you’ve been investing your £200 per month from the age of 23, which you’ve then increased to £500 per month from the age of 33, and it’s grown by an average of 10% per year, compound interest will mean that you’ve got a pension pot of around £875,064 at the end of your 55th year. Using the 4% rule, you should be able to take a pre-tax income of £35,000 per year and have the original pension pot remain the same.

Most importantly, it gives you a choice. Just because you’re now financially secure and could retire, doesn’t mean you have to.

Debt

If your job is going well and you’re still earning a salary each month, your focus needs to be paying off any debt leftover and bolstering your retirement fund. This is the last chance to save and pay off debt or support your retirement fund.

Once you’ve retired, your only other option to raise cash is a lifetime mortgage where you take equity out of your home while retaining ownership. The money is interest-free in the immediate term, however, interest is collected when the initial amount is collected on the sale of the property.

The idea is that you take the cash and pay off the mortgage or bolster your retirement fund and once you’ve finished living in the property either through moving into long-term care or death, the loan is repaid. This type of loan is something you must speak to your financial advisor regarding.

Investments

Your 50’s is not the time when you should be adding risk to your portfolio. Sadly, if it goes wrong, you don’t have the time to make it back up. As a consequence, you need to make sure your portfolio is both low to medium risk and full balanced across the bond, equity and commodity markets.

One point, its all very well reducing the risk out of your investment portfolio, but you need to make sure you’re still making a good return on your money otherwise you could run into inflation problems. Inflation is the number one pension destroyer. It destroys your pension by reducing your buying power. As an example, something that cost £25,000 today will cost £41,015 in 25 years if you assume a 2% inflation rate.

UK State Pension

If you’ve paid 35 years or more of national insurance contributions each month and were born on or after the 6th April 1951 (or a woman born on or after 6th April 1953), you’ll get a full state pension. If you have paid between 10 and 34 years of contributions, you will receive a proportion of the pension and less than ten years of NI contributions, you aren’t usually eligible for the new State pension).

If you haven’t paid the full 35 years, now is the time to make catch up payments to make sure you’re receiving the total amount.

Children

Watch out your children don’t become financial dependant on you; otherwise, this can be a significant drain on your finances. We all want to do what’s right for our children, however, bailing your children out financially is not the right move and can have a detrimental effect on your own goal.

Your children can borrow money to go to University if needed, however, if you spend your retirement pot bailing your children out and then lose your job due to your age, life becomes complicated.

Protection of Assets

If you retire age 55 with a million pounds in your bank account, asset protection is going to be of high priority to you. This is something you need to speak with your financial advisor about, as it both, depends on the rules and the amount of money involved.

Sadly the rules that we have today for things life tax inheritance are likely to not be the same in ten years’ time when I come to retire. The specific areas you need to focus on include;

- Protecting assets from the tax man

- Make a Trust to minimise estate tax

- Make sure all your accounts have the correct beneficiaries

- Update your Will

- Protect your savings from institutional failure. Remember the government guarantees bank balances up to £85,000

- Financial gifts are inheritance tax-free (Subject to the 7-year rule)

Final Thoughts

Retirement at 55 or before is the target for me and a lot of people like me. With time, compound interest and following a few investment strategies and key goals, I will get there and you can to.

The next think to think about, once you’ve reached your target, do you want to retire and what’s best to do with your pensions.

Good blog post

Hi David, an interesting read. What are your thoughts about priority when it comes to investing versus paying off a mortgage.

Hi James, I think this comes back to the age old question, how much does your mortgage cost? In the UK today, you can get a £150K interest only mortgage at 1.30% for around £180 per month. Personally, I’m, okay running this debt and therefore my focus is on investing. The FtSE 100 gained 12.1% in 2019 therefore this capital growth would substantially off-set the 1.3%, I’m paying for the mortgage.

If the interest was 6%, this would be a different story. I would now be paying £750 per month and while if the stockmarket went up 12%, I would be able to off-set the mortgage cost’s, the risk would be high. In this case my focus would be paying off the mortgage to reduce it to levels where I’m comfortable paying the interest.

Cheers, David

Glad to know more valuable information here!

David hi

What would you do in my position ,

I have some savings & a state pension .

I would like to make extra income .

How should l invest £40,000

Hi Sally – For any investments, I would speak to a qualified financial advisor who will be able to advise you on the best course of action, for your specific situation. I can only tell you how I invest, and you can read that here – https://www.theretirementblog.co.uk/investing/how-to-invest

One point, before you invest with Financial Adviser, make you sure you have answers to these questions – https://www.theretirementblog.co.uk/advice/financial-adviser/questions-to-ask-your-financial-adviser

What about poeple real world on 17000 a year working in nhs

Thank Steven, but I started on less than £17K and I still managed to save for my retirement. Just because you work in the NHS and earn £17K does not mean that you cannot save money but you will need to prioritize your spending and saving. It also doesn’t mean that you cannot spare an hour a day, to work on a side-income.