This year has been an excellent year for investing in the stock market. The FTSE 100 is up 9% this year, the S&P 500 is up 22%, and things are looking great. In all honesty, the last ten years have been pretty amazing for me. Last year I made 24%, the year before 17% and the year before that, a massive 29%. You have to go back to 2008 for the last time that I made a significant loss.

The Truth

I was asked the question last week; how do you do it? How do you make such good returns? The honest answer is I cheat. Yes, I have my core investments in both ETF’s and Single stocks, but I also have a few more speculative investments that I get from an investment service called Motley Fool.

I first signed up for the service about five years ago because I wanted help diversifying my portfolio. In those days, I was investing in a few large-cap technology companies and a few index ETF’s. The problem was that I was starting to build up substantial assets in one company or one area of the market. The service helped me diversify my portfolio from a company perspective (I now invest in about 60 different companies), and from a sector point of view. I invest in everything from property to Oil and Gas, and from financial instructions to technology.

What I like the most about this service is the fact that the recommendations come after extensive research. These are not picked from your “investing guru” best mate who actually has no idea. They’re chosen and evaluated by professionals. Together with a monthly stock pick, you’ll also have access to a report that explains the stock recommendation and rationale behind why they have chosen that stock.

Remember, the recommendation is not a “must buy” event. If you read the analyst report one month and feel this stock is not for you, you don’t have to buy it.

Motley Fool

Motley Fool was initially founded in July 1993 by David Gardner and Tom Gardner, who still run the company today. Over the last twenty years, the company has grown to one of the largest financial media companies in the world.

The business provides both free financial news and stock recommendations, however, if you want premium financial advice, you need to pay for it and thus, there is a subscription service. The paid plan provides three sets of research-backed advice, starter stocks, best buys and monthly buys. Using the program is incredibly simple. The company tells you the best stocks to buy, and then you can purchase them in your brokerage account.

- Monthly Buys – twice a month, the stock advisor program offers stock picks that are backed by extensive research.

- Starter Stocks – These are ten stocks that Motley Fool recommends for the long term. They are time-tested companies that have proven to be great investments in the past and are likely to remain great investments in the future. Effectively, you can buy these stocks and hold them for the foreseeable future.

- Best Buys – These are stocks that the motley fool team think are good buys today. Either they are about to report, and the team feels their share price will increase, or their growth has stopped or stagnated, and the team feels this growth will start again. An example, UpStart Holdings, the recommendation was made on the…………

UK, US, Australia, Canada, Japan & Germany

If you’ve read my blog for any length of time, you’ll know that I focus on the UK markets as I’m based in London, however I both invest heavily in other core markets such as the US and have many readers across the US.

The Motley Fool understands this and provides a global reach towards investments in other countries. Yes, you have to sign up for different plans for each country, but the service is the same worldwide. Personally, I have just got plans with the UK and the USA as these are the markets that I focus on the most.

Performance

The big one, what’s the performance been? Seriously, it’s incredible, really, really impressive. Don’t get me wrong, there are some shockers along the way. Skillz, which I bought six months ago, is down 60%, Lemonade is down 50%, and Airbnb, which I bought at the beginning of this year, is down 20%.

That said, there are some serious returns as well. Crowdstrike, which I bought about a year ago is up 194%, SHOP, which I bought at about the same time is up over 340%, and Tesla which I purchased at the beginning of last year, is up over 700%.

Given there are two subscriptions that I pay for each year, there are two reports, one for the USA and one for the UK. Remember, these are just the monthly recommendations, not the best buys or the core stock.

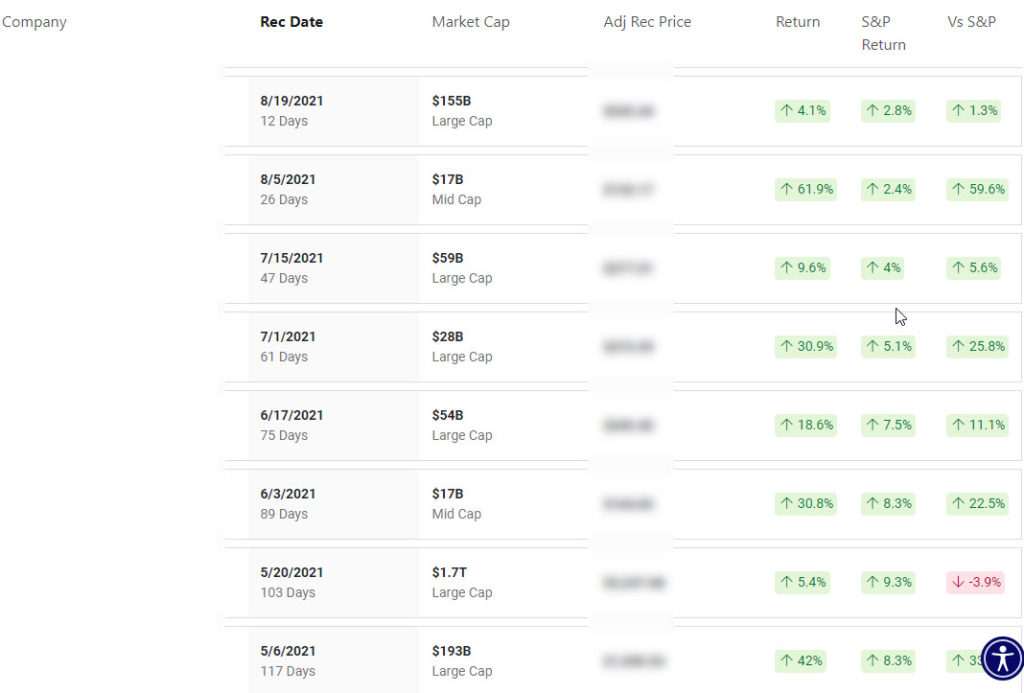

USA Recommendations

In the USA, the returns are seriously impressive. Out of the last 40 stock picks, thus going back to the first pick of 2020, there are nine stock picks that are in negative territory, the rest are positive, with seven stock picks having returned over 100%. Including all the recommendations that are still losing money, the average return per stock recommendation is 57.8%.

The below image is taken directly from the performance section of the platform. I have knocked out the companies, but you can clearly see the last eight recommendations that have been made and the associated performance in the short term, with each recommendation.

Join the US Platform by clicking here

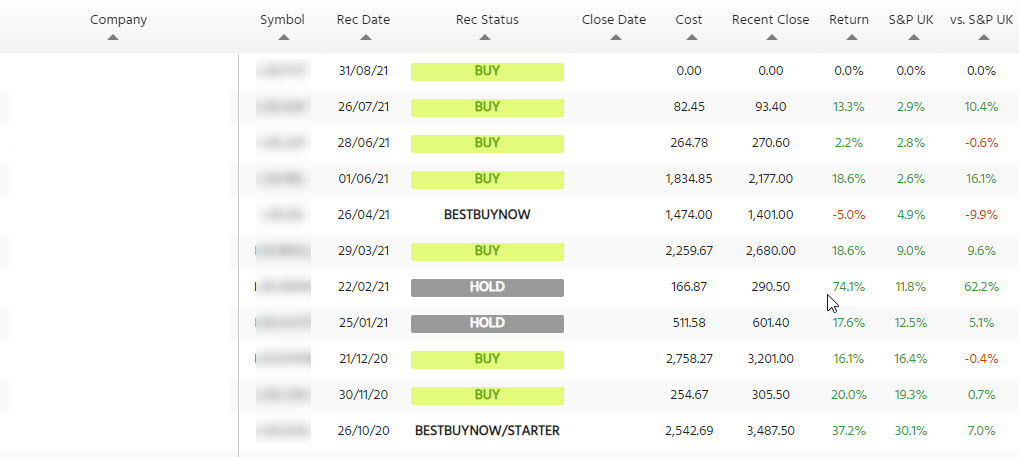

UK Recommendations

Things are not as great in the UK, but then the service is slightly different, and the UK market has not grown as quickly as the US Market. You’re given on “Fire” Recommendation and an “ICE’ recommendation each month in the UK. In general, Fire recommendations offer a higher risk to reward profile than an ICE recommendation.

In terms of performance, of the 18 fire recommendations since the beginning of 2020, only three have lost money, however, there are only three above 100%. Of the ICE recommendations in the UK, only two have lost money, but there are none over 100% during this period and only two above 50% return.

Similar to above, the below image is taken directly from the performance section of the platform. I have knocked out the companies, but you can clearly see the last eleven recommendations that have been made and the associated performance in the short term, with each recommendation.

Join the UK platform by clicking here.

Final Thoughts on Motley Fool Stock Advisor

My impression of the Motley Fool stock advisor service is very positive. It’s something that I pay for each month and will continue to pay for going forwards. One point does need to be made clear, this is not a service for investors with short time horizons, you need to be thinking in terms of a few years to make this service work.

Yes, there are a lot of short-term wins, but to make the investment returns, you should be holding recommendations for a minimum of five years.

At only $99, you really cannot complain too much about the Stock Advisor service. Furthermore, memberships are backed by a full refund guarantee to ensure customer satisfaction. In my opinion, you cannot go wrong with this service.