The Retirement Blog is written by me David Jacobs. Very simply, I’m on quest to retire early and get out of the rat race. I’ve had enough of working, six in morning train rides to London, eight in the evening finishes and look forward to that time when my schedule can be planned around what I want to do.

Who Is David Jacobs?

Good question. The honest answer is that i’m just a normal guy, working in finance in the UK, with a wife, two kids and dog. I earn about £100,000 each year and I’m trying to retire at the age of 50-55.

I have a normal life, there is very little different between me and you other than the fact I’m working in Finance. My plan has always been to retire early, however without earning the mega-salaries, this dream is a while away.

Probably what is different between you and me, I don’t believe in financial advisers and I think we should all have a job on the side that can help pay the bills. As I said above, I earn about £100,000 each year, however only about half of this comes from my full-time job, the rest comes from my side-jobs.

Financial Adviser

To be clear, I’m not a practicing financial adviser. I’ve met a selection over the years, although I’m yet to find a financial adviser with as much knowledge as I have built up over the last few years.

To honest, I don’t think financial adviser’s are worth speaking to unless it’s something very specific and technical. If you want to structure an offshore/onshore trust, with a debt program, to limit tax inheritance, this could be something that you need to speak with a financial adviser or you risk getting yourself into a whole world of trouble.

Let’s be honest, if you want to it, this website is probably not for you, but neither is the typical financial adviser that you’re going to meet with.

Financial Adviser – Fees

My biggest problem with financial advisers, is their fees. Fifteen years ago (dam I’m getting old), I was just starting out my career. I met with a financial adviser who introduced me to the topic of retirement.

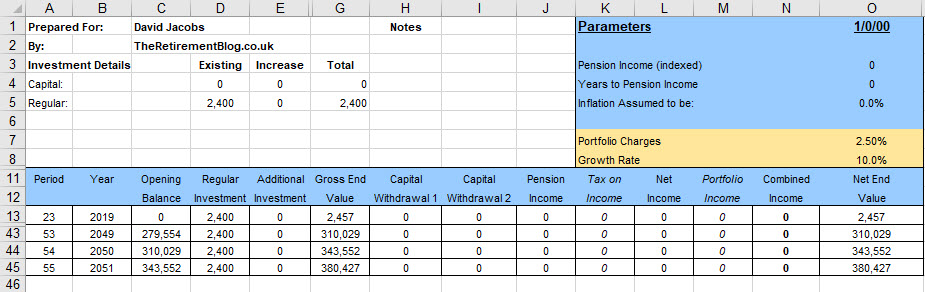

He said that if I saved £200 per month from the age of 23, to the start of my 55th birthday (i.e 31 years) and it grew by 10% each year, at the start of my 55 birthday, I could retire with a pension pot of £343,553, which equates to around about £1,145 per month in income for the rest of my life (using the 4% rule).

This is not a huge number, but if you assume you’d get another £559 per month from your state pension (obviously this depends when you retire), things start to look quite good for early retirement.

The Problem

The problem, those annoying charges have a serious effect on compound interest over the 31 years. The problem with financial advisers, they all charge an amount for their services, which can seriously damage your pension.

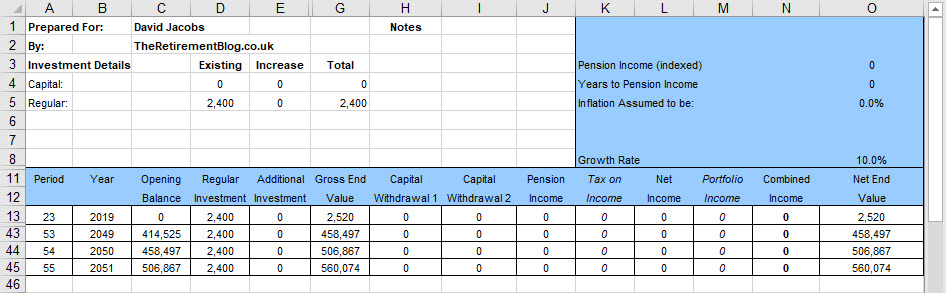

As an example, below is a spreadsheet (Yes I love my spreadsheets to show the real cost of things, showing if you invested £200 per month, from the age of 23 to end of your 54th year (I.e. 31 Years) and it grew by 10% each year, but time, you invested yourself and not through a financial adviser, allow the fees to be ZERO.

The effect is huge. At end of the 54th year working, you’d have £506,000 in your pension pot giving you an income of nearly £1,700 per month.

My Beliefs

I believe we should all have a day job that hopefully provides for our family and starts to build education funds, pension pots and in an ideal scenario, early retirement.

However, and this is probably the difference between you and me, I also believe we all need to create money through side jobs, save money through disciplined saving schemes, invest these savings on the stock-market or other investment vehicles as this is really the only hope, we all have of retirement.

If you need help along the way, we’re hear for you, to try and answer any question you have along the way.