Retirement is a part of our life that many are looking forward to, but also dreading. I’m looking forward to it, and I’m looking forward to not being forced to work every day and to be able to enjoy my life.

That said, I know a lot of people who dread the thought of having to retire. It’s not because they don’t want to work, and it’s not because they haven’t got things they would like to do, it’s because they are like nearly a third of the UK workforce who does not have a pension.

Pension Pot

To retire at some point in the future, you need to build a pension pot that you take a monthly income either using something like the 4% rule, or you use a drawdown method. What generally happens is that life throws us off track from even the best-laid plans. You start saving in your twenties, and then you want to buy a house, so you use the money you have saved up for a deposit.

You then start to earn more as you’re promoted in your career, but married life, children and holiday’s with the family take priority, rather than saving for your future. You’re also not smart, and you don’t max out your company contributions or even in many cases take advantage of ISA’s and other tax-free products.

This leads to a light-bulb moment, typically around the age of 40, when the average person starts taking retirement more seriously. The question comes up over light conversation and makes you start to think about what you have, and more importantly, what you need to be able to retire and enjoy your financial freedom.

Financial Freedom

Are you on track to retire? In all honesty, the vast majority of people that I speak to wouldn’t know whether they were on track to retire, or even how to work out how much they need in their pension pot to retire. So how do you go about working this out?

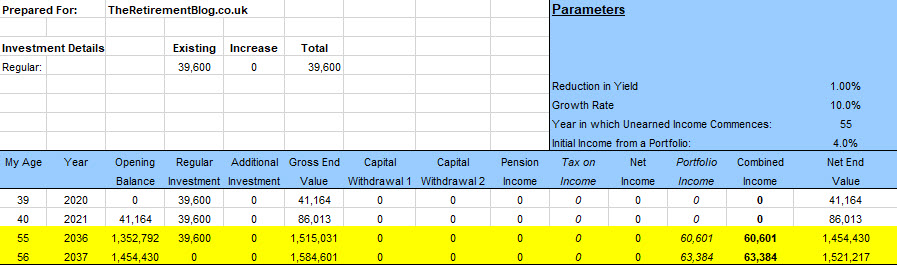

The below table shows what I need to retire at the end of my 55th year, with £3,000 per month income for the rest of my life. It also shows what I would need to save each month if I’m starting with nothing aged 39 to get to this figure using a 10% growth rate, 1% costs and a 16-year timescale. So how did I get these figures?

Step One – The first question you need to think about is your “years to retirement”. I appreciate for a lot people the answer is tomorrow, but realistically, when would you like to retire? Remember, retiring does not mean that you have to stop working, but it gives you the financial freedom to make the choice yourself. Today, I have no choice but to go to work each day, I need to earn my salary each month to pay for my family.

In my case, I’d like to be retired by the time I’m 50, however with two kids, realistically, this is not possible. I do think 55 is realistic. I’m 39 now, which means 16 years to retirement.

Step Two – The second question you need to think about is the amount of money you need to have each month to keep your lifestyle as you would want. In this example, I want to have £3,000 per month spending money each month.

This is pure spending money as I will not have to save money each month and it to pay for day-to-day life. I have a separate budget below that I will use to pay for bucket-list holidays.

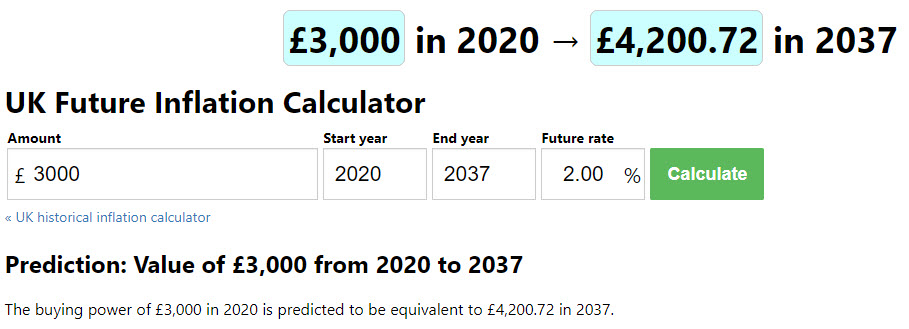

Step Three – You need to add inflation to your monthly salary. The spending power of £3,000 in twenty years time will be less due to inflation we need to take this into account. The easiest way to this is with an online, compound interest calculator. With UK inflation being around 2% for the last 25 years, adding 2% compounded for the next 17 years, means that actually I need £4,200 in 2037 when I come to retire.

Step Four – What’s the tax rate? Sadly we don’t know what the tax rate will be in 17 years, but we can have an educated guess based on today’s tax rate. In this example, we’ll need a monthly income of £4,200 (£50,400 per year). Grossing this figure upwards to include tax, we need a Gross Income of £60,000 a year. (£60,000 Gross – We will get £12,000 tax-free, and the remaining £48,000 would be taxed with a basic income tax of 20% leaving £38,400).

Step Five – Calculate the size of your pension pot using the 4% rule. The rule basically suggests the amount of money you can take out of your pension pot each year, and still allowing for a healthy bank balance that can be used for the whole of your retirement, whether than ten, twenty or even fifty years.

I like the 4% rule as it provides a steady stream of income while taking into account a realistic rate of interest using a low risk, heavily diversified portfolio. For £60,000 per year, I’d need a £1,500,000 pension pot at the age of 55.

Step Six – Add the cost of a property as you need somewhere to live. In this example, I’ve added on £300,000 for the cost of a property. When you’re choosing an amount, you need to be realistic. I have friends who have put down large figures because they live in a large house in London. The first question, are you really going to want a large house for just the two of you? Secondly, do you really want to love in central London?

During my conversations, most agree they would realistically sell the large family home and move into a smaller unit that they could actually manage and save the added expense.

Step Seven – Add on an amount for your bucket list. I’m adding on £100,000 for my bucket list items. There are things that I want to do and see before I leave this planet, and none are cheap. At the top of my list is a trip to Antarctica, which will easily got £20,000 per person, however I also want to see Machu Picchu, Everest Base Camp and even take a drive across the USA.

I have planned these trips, and budgeted for them.

Grand Total – £1,900,000

My grand total that would give my family and me a comfortable retirement for the rest of my life is £1,900,000. The next step is to work out what you have, and more importantly, how much you nee to save each month, to make your financial freedom target.

- State Pension – I assume 35 years of contributions and a full state pension of £10,363 (current state pension factoring in the consumer price index in 2037), but given you cannot access your state pension until you’re the age of 68, I have not included it in these calculations. The next problem, the government has announced that the minimum retirement age has been increased to 57 from 2028 and therefore if I’m serious about retiring aged 55, I would need this outside of any personal pension plans.

- Property – we live in a four-bed house that we bought in 2013 for £450,000 using a £150K down-payment and a £300,000 mortgage. It costs £1,242.56 in repayments using an 80% Loan to value (LTV), fixed for five years at 1.80%. At current rate, I’ll have this paid off my the time i retire in 17 years time and depending on what life throws at me, I might even downsize at some point in the future and add the outstanding cash to my pension pot.

- Pension Pot – I am in my 18th year of saving, starting out with just £200 per month, I have grown my pension pot to £336,823. This is held in a combination of ISA’s and SIPPS. If you want to see what I do with my money, click here to see how I invest.

Am I On Track?

Am i on track for a successful retirement? I feel that I am on the right track and heading in the right direction. I’m never going to be a multi-millionaire, but I will be financially secure and be able to retire as planned.

As it currently stands, I can see the house being paid off, but I need to add £1,236,177 (1,600,000 – 336,823) to my pension over the next 16 years. At my current saving rate, this is easily achievable as show below.

The table shows that if I take my current £336,823 and increase it by £500 per month, and it increases by 10% each year, while allowing 1% of costs, at the end of my 55th year, I will have a pension pot of £1,675,871, allowing for an income of £67,035 using the 4% rule.

Finally

I have used the 4% rule as the basis for my pension pot, however it’s by no means a perfect rule when it comes to retiring. The 4% rule assumes that you’re going to spend a set amount each year, while the original portfolio remains the same, allowing it to be passed to your children. The key problem, lots of people I’ve spoken with over the years don’t want or don’t have anyone to leave their assets to, and would rather spend it. As a result, using a drawdown method would allow you to retire earlier, or spend more during your retirement.

There is also the factor of when you’ll want to spend your money that the 4% rule does not take into account. Personally, I plan to do a lot of travelling in the early part of my retirement and I have specifically saved an extra £100,000 to do this. There are a few seriously expensive holidays that I want to take as they have been on my bucket list for a while, such as Antarctica and the Arctic oceans. I know I’ll be spending more in the first few years crossing of these bucket list items, but once they’re done, what am I going to be spending my money on?

I budgeting for £3,000 per month, but if I cannot travel due to health reasons, or don’t want to travel, and the house is paid, what exactly am I going to spend £3,000 per month on. Maybe I should be either trying to retire earlier, or spend my money faster in the early part of retirement, knowing that I’m unlikely to spend it in the latter.

Great post!

I used the 4% rule to reach my pension pot at 35, but it is hard to believe it will last for the next 35-55 years… I am now strengthening other sources of income to be able to confidently throw away my corporate job.