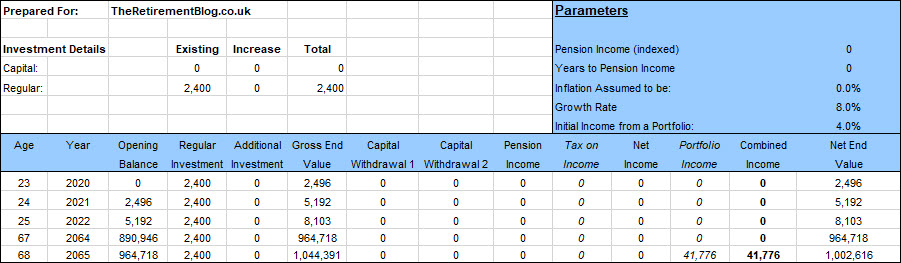

Saving money comes down to one thing, spending less than you earn each month, If you earn £1,000 and spend £800, you’ll save £200 each month. This £200 that you save each month, could be the difference between retiring a millionaire, or not retiring at all. The below table shows what happens if you save £200 per month, from the age of 23 to 68. The short version, you’d be a millionaire.

Most people that we speak to don’t save. There is always an excuse, a reason why they could not save money that week or that month. Remember, we’re not talking big numbers here to retire a millionaire, but we are talking about saving money each month, while thinking about your purchases. Where can you save £2,400 per year?

Track Your Money

We are all guilty of whittling away money on an ongoing basis with seemingly no idea where our money has gone. It is therefore a great idea to begin tracking your money on a daily basis to understand your spending habits and how you can better manage them.

Below are 51 places that you could save money each month.

Online Savings

Automatic Savings

There are a fleet of different applications that all work in a very similar way and have the aim to save you money automatically. Below are three of my favourites that all have saving features, but work in a slightly different way.

- Chip – this free app takes small amounts directly from your current account and transfers it into a savings account with you noticing. While the app does not currently pay interest on those savings, it makes it very easy to transfer out monthly to your investment account.

- Monzo – is very similar to the above, but allows you to track your spending, divide that spending into categories and alert you if you’re spending too much in one section. Like the above application Monzo allows you save money automatically, however unlike the above app, it does pay interest your savings.

- Starling Bank works slightly differently, rather than taking money from your account, it shows you were your spending your money and act like a traditional savings account with the benefit of a tracking platform to you were you’re spending your money.

- Yolt – isn’t a bank account as such but shows how much you’re spending on different items, and then provides advice on how to save money.

- Plum – this saving application works by letting you automate your savings by rounding up transactions. As an example, if you buy something for 7.56, it will round up this transaction to 8, and save the 44p into your savings account.

Emma

This is not a bank account, but at application that looks at your bank account to understand where your wasting money, and alert to you any excess fee such as for overdrafts or subscriptions. As an example, I had a Spotify account that in all honesty I did not use very much and totally forgotten that it was costing me #10.00 per month until Emma reminded me.

Use an Incognito Browser

It’s important that you use an internet browser that does not track your history as this can affect prices. Effectively, companies will track your progress around the internet, if you look at the same thing more than once, the prices will be similar as companies know that your wanting to buy.

Saving Money – Personal Savings

Free Ways to Save Money

There are numerous free ways to save money and while most involve some form of sacrifice, they all save money and can help with your health.

- Set Saving Targets – Put in place a target at the beginning of each year which you can review on a monthly basis. For example, you may decide to target an annual saving of 10k. Each month, you can tick off your savings and if you fail to meet your monthly target, you can always make up for it the following month.

- End of The Day Change – We all accumulate small change over the course of a day which we can often be guilty of discarding. The plan is to save and accumulate this cash, then add to your savings account.

- Money-Saving Challenges – you don’t have to do these the whole time, but they can be a fun way to save money. Challenges include the no lunch challenge where you don’t buy lunch for a week, the no going out challenge where you try not to spend money on going our for a month, and the no alcohol challenge where you don’t drink alcohol for a month.

Cut Your Own Hair

Now, this may be deemed a little risky, but if there is someone in your home who has experience cutting hair, then by all means, have them do so. Trips to the barbers and/or hairdressers can soon add up so, if given the opportunity, cut your hair from home.

Carpool

Not only is carpooling a more environmentally friendly approach to travel, but it is also economical. You can carpool to work, school runs or even for your trips to the gym or cinema. If you do not own a car, you will save a substantial amount of money by contributing toward your friends fuel outlay and not having to incur the costs of daily taxis. If you are a car owner, taking the driving responsibility in turns on a monthly basis would not only cut down on your fuel costs, but also your cars mileage.

Do Not Speed

Speeding is not only dangerous to yourself and other road users, but it can also be costly. Have you considered what you would do in the event of losing your driver’s licence as a direct result of accumulating points due to speeding? How would you get to and from work? What would you do for the school runs, or in the event of an emergency? Avoid expensive speeding fines or potentially losing your licence by abiding the speed limits.

Nights In

As we all know, socialising can be a costly affair. To save money, it can be a great idea to invite friends over to your home for dinner and drinks as opposed to eating out. You can take it in turns to host evenings at your homes and could even suggest that you all pick a different theme for each week or month, ensuring that you have a lot of fun and variety.

Prepare Lunch at home

Whether you are eating in your work canteen or popping to the local bakery for a freshly made roll on your lunch break, the cost of eating out soon adds up. Preparing a packed lunch to take to your work will not only save you money, but will also save you from the temptation to agree to go for a business lunch, or from purchasing any additional goods when picking up your sandwich, and drink.

Eat less meat

We are all aware that good quality meat can be expensive and so cutting down your meat intake to once or twice per week will help to reduce your weekly grocery bill.

Quit Smoking

We all know the associated health costs to smoking but we also need to consider the damage smoking causes to our bank balance. Try cutting down on your daily intake and eventually quitting. If you consider that the average cost for a pack of 20 cigarettes is £10 in the UK, and some people can easily go through a couple of packs per week, this would average a total cost of £1,040 per year. This is a substantial amount which you could instead contribute to your savings. It is also worth nothing that insurance providers place a premium on life insurance payments to those who smoke.

Consider Alcohol Intake

Have you considered your monthly alcohol outgoings? Alcohol is expensive. For example, you can buy a four pack of Corona for £5.00 versus paying an average of £3.00 per bottle in a bar. Therefore, if you choose to drink, it is wise to consider having friends round for a sociable gathering as opposed to eating and drinking out.

Pay off Short Term Debts

We all have long-term debt, but the point is that it’s often economically attractive to have this debt, however the same cannot be said for short-term debt such as credit card debt, which has a higher rate of interest. It’s important that you pay this debt of quickly, as it’s a total waste of money paying interest.

Debt Transfer

If you have built up substantial debt on a credit card for example, it could make sense to transfer the debt to a long-term debt solution where the interest rate is much lower. The problem with credit card debt is the interest charged. A typical personal loan will probably be charged at 5%, however a credit card loan could be charged at 30%. This would mean on a 10,000 credit card-debt; you’re paying 3,000 per year in interest alone. The idea behind a debt transfer would be to transfer that debt on a high interest product such as your credit card, either to an interest free credit card, or to a personal loan where the interest is lower.

Switch Mobile Phone Plan

If you find that you don’t make full use of your monthly data and/or minutes on a regular basis, research the market to see what deals are available. You can then speak with your current network provider about downgrading your plan and seeing what offers they can make to you. If they are not able to offer you a better package and you can exit your contract with a minimal penalty, switch provider to help save money in the longer term.

Cancel Subscriptions

Subscriptions, no matter how small, all add up. It is beneficial to take the time to go through, note and review all subscriptions that you have. You will most likely unearth subscriptions that you had completely forgotten about and no longer have a requirement for. Another good idea is to speak with family/friends about their current packages and the possibility of teaming up. For example, Netflix allows you to add friends and family to your account for no additional cost, as does the music app, Deezer. This could help save a substantial amount of money over the course of a year.

Student Loan

Although the interest rates on student loans have historically been low, have you considered how much accumulated interest you have paid over the course of the term? If you still have outstanding student loans, it would be beneficial to pay them off sooner rather than later to reduce the overall compounded interest.

Switch Bank

We are all guilty of banking with the same bank as our parents and their parents before them, but in this day and age, there are a number of stable banks to choose from which are offering an array of suitable bank accounts. Take the time to shop around to identify if there are any banks offering account sign-up bonuses, a more attractive interest rate, reduced charges for overdraft facilities and so forth.

Rail Cards

If you travel to work by train, make sure you’re taking advantage of rail card discounts. As an example, there is a 30% discount on a 16-25 rail card, but you’re allowed to buy a three-year rail card the day before you turn 24 so it’ll last up to the age of 27. There is also a 26-30 railcard that gives you a 30% discount on all travel and you can buy a one-year travel card up until the day before you turn 31. Make sure your taking advantage of these savings.

Train Tickets

It depends on the distance you’re travelling, but sometime it can make sense to buy two train tickets, rather than one. As an example, I buy one ticket to get me from my home to Waterloo and another to use the underground. This works out cheaper than buying a travel card, websites such as Trainsplit and Ticketclever will tell you if a split fare is cheaper.

Pre-Booked Tickets

Much like flying, buying a ticket on the day is always going to be the most expensive option. If you pre-book your train ticket in advance, you can often get discounts. As an example, I recently took a train ride from London to Scotland. If I had book on the day, it would have cost almost 200, however I booked two months in advance and paid nearly 50% less.

Personal Finance – Savings

Dividend Allowance

As the rules stand, you can earn £2,000’s worth of dividends completely tax free. Once you have exceeded this allowance, it depends on which tax bracket you’re in, to how much tax you pay. As it stands, basic-rate taxpayers pay 7.5%, Higher-rate taxpayers pay 32.5%, and top rate taxpayers pay 38.1%.

Capital gains tax (CGT)

As the rules stand today, the first £12,300 of earning are tax free. After this, any earnings you make will be taxed at the basic rate which is currently 28%. Remember married couples can claim a double allowance of £24,600, but it you don’t use the allowance, its lost forever. You cannot roll it over to the following year.

ISA’s

Its important that you’re taking advantage of all the tax-free schemes that are available to you. As an example, you’re currently allowed to pay into an ISA 20,000 per year and let it grow tax free. If you pay into a Stocks&Shares ISA and then invest it on the stock market, and let’s say you made 25% as I did last year, you would have made 5,000. However, depending on your tax rate, you could have lost 40% of this profit to tax if it was not inside an ISA.

Use Your Spouse

Remember, it’s 20,000 per person into an ISA. As such, if you have spare could be worth transferring assets into her name and allow them to use their allowance. On the same token, this doesn’t just apply to using allowances for ISA’s, you could also transfer assets into their name allowing them to take advantage of a lower tax bracket.

Junior ISA’s

As the rules stand, you can give your children 9,000 per year into a Junior ISA and allow it to grow tax-free. The only cravat, with a junior ISA, they cannot access the money until their 18th birthday.

Capital Growth Vs Income Gains

If you have a portfolio outside of an ISA, you need to make sure you’re going for capital growth, rather than income gains. As the rules stand, the Higher-rate taxpayers pay 20% on capital gains, but 32.5% on dividend income.

Enterprise Investment Scheme

allow you to buy shares in early-stage companies and deduct 30% of your investment from your income tax bill for the year. This scheme is limited to £1 million, but that’s still a potential saving of £300,000.

Property Rental

While income from your property rental is taxable, you can deduct a range of costs from your income including gardeners and cleaners, letting-agency fees and accountant’s fees. You can also claim against kitchen equipment being replaced, however you can only claim for a like-for-like replacement. But this only applies to items being replaced, not those bought for a property for the first time. You can also only claim the amount for a like-for-like replacement.

Trading Cost’s

If you anything like me, you probably try to save each month from your salary, and then invest those savings on the stockmarket buy company shares. In the past, I’ve paid as high as 25 to buy and another 25 to sell on the stockmarket. With competition in the market, prices have been reduced to the point where you can trade for free, or in my case, pay a much lower trading fee.

Shopping Savings

Supermarket Shopping

There are lots of tricks that you can use to save money in the supermarket, for example, do you shopping in the evening for the best deals on food, especially foot that will go off than day. On the same token, if you go to sandwich shop for lunch, go after 3pm. The choice is limited, but you will get a substantial discount. Other trucks include comparing prices on apps, finding non-branded duplicates that contain the same product at half the product and looking at the unit price for multiple products as often it’s just a ploy to make you buy more.

Meal Plans

These are a great way to reduce spending at the supermarket. The problem with supermarket shopping is that they’re designed the sell you products. As an example, every product at your eye-line will be a premium product with a much cheaper version below, on low shelves. If you go to the supermarket with a list of products that you want to buy, you’ll be less likely to buy “want” products, rather than sticking those that you actually need. Most importantly, avoid products on the end of the aisles as they are set up to sell expensive products to consumers.

Impulse Purchases

If you find something that you were not planning on buying, remember that the item will still be in store the following day. Avoid making costly mistakes by going home, sleeping on it, and taking your partner or friend along with you to the store the following day to minimise the possibility of you making an expensive mistake.

Cashback Website

Websites such as TopCashback and QuidCo give you cash back when you buy products. For any shopping other than food, the first place I go is a cashback website to see if I can buy the product I want, and get cash back on my purchase. Remember most cashback websites are free to use, but they often have memberships plans that provide you a higher rate of cash back. Before you go out a sign up, it worth thinking about how much you’re going to use the cashback service before buying membership.

Amazon Trackers

I do a lot of shopping on Amazon. Some is urgent, but lots can wait and a result I use CamelCamelCamel.com which alerts me to when the price has reduced. As an example, I wanted a pair of earphone, however they has just been released and the price was sky high. I added them to my account and six week later was sent an alert to say the priced has been reduced 30%.

Buy Quality

As my grandmother used to say, “pay for quality once, and you’ll never have to pay for it again”. Yes, the initial outlay when purchasing a quality item will be more, but you will save money in the long run as quality products have more durability and will last for longer.

Used Luxury Goods

There are a wide variety of used luxury goods that are available to purchase online or in a shop. I have always wanted to purchase a Rolex but would far rather save a couple of thousand by purchasing a second-hand watch in good condition than pay full price for a new one.

Discount websites

There are various websites available online which offer brilliant deals such as two for one offers, heavily discounted meals, hotel stays, spa trips or even vacations abroad. Such websites include Wowcher, Groupon, and Itison, which are free to use and only require you to sign up in order to access the deals.

Christmas Sales

It is very beneficial to wait and make use of Boxing Day sales for any large purchases that you wish to make, such as a new homeware appliances. If you are good at planning in advance, it can also be useful to purchase the upcoming years Christmas and Birthday presents in the sales to help you save that little extra.

Shopping List

Creating a shopping list before you go grocery shopping is a great way to keep you on track and remind you what you are there to purchase so that you are not buying unnecessary goods. A shopping list also helps you to plan efficiently for the week ahead so that you more easily stick to meal plans, reducing wastage.

Buy Non-Branded Goods

When grocery shopping, you should consider purchasing the “in-house own brand” products as opposed to the “house-hold name” goods. For example, Kellogg’s Crunchy Nut cornflakes will cost you £3.00 per box whereas you can purchase a box of Tesco’s own branded Honey-Nut cornflakes for only £1.00. Yes, there may be a slight quality difference, but this is often minimal, and worth the substantial saving!

Coupons and Loyalty Programs

It is a fantastic idea to sign up to available loyalty programs. Signing up will often mean that you are informed of upcoming and current deals, and as you accumulate points, you will benefit from discounts and money off vouchers. It is also worthwhile checking magazines and newspapers for various coupons which can be used in an array of shops.

Bulk Buy Staples

Exploit as many advantageous offers as you can, particularly those on expensive, non-perishable items such as toiletries. When you see your day to day products on special offer (think buy one get one free) stock up on as many of the items as you can. Not only will this help your overall spending, but it will also reduce your travel time to and from the store, saving money on fuel.

Buy Second-hand and Sell Unwanted Items

As mentioned above, selling unwanted clothes is an excellent way to save and make money, and you can do the same with the vast majority of your belongings. For example, whether you are a first-time parent or a veteran with five children, we are all aware of the costs associated with having and looking after children. To help ease the financial burden, consider purchasing good quality second-hand items such as highchairs, car seats, prams and even wardrobes. The Bugaboo Donkey Duo pram is a classic example; this will set you back around £1,500 when bought new but will cost a mere average of £600 when purchased second-hand. If well looked after, the pram, along with other mentioned items, could be re-sold once your child(ren) have outgrown them. You can do the same with toys and even clothing, saving you a significant amount of money.

Save Money At Home

Your home is the number one place where you can make major savings with a simple bit of planning and thought process.

Thermostat

Turning the heat down in your home by just one degree, can reduce your heating bills by 10% per year. As a consequence, rather than walking around in shorts and t-shirt, consider wearing more clothes, and turning down the temperature to save money.

Split Thermostat

There is no point in heating rooms that you don’t use. As example, we have a spare bedroom that we don’t use unless someone is staying over. We therefore don’t heat that room to save money on our heating bill, and only switch the heating on if someone comes to stay.

Block-Up Chimneys

burning wood is a great way to heat a room, especially if you did not have to buy the wood in the first place. The problem though, when it’s not in use, it can feel like you have an open window with all the cold air streaming down the chimney into your room. If you’re going to use a chimney, make sure you also use a chimney balloon to block the chimney when you’re not using it.

Double Roof Insulation

30-40% of all heat that leaves your home, leaves through the roof. It makes sense to firstly insulate your loft area, but also double up this insulation to make sure that you’re not losing heat through your roof.

Hot Water Tanks

It’s important that you insulate your hot water tank to make sure that it stays warm for a long as possible to save energy. Insulation is not expensive, however by using insulation that is 100mm thick, you can reduce heat loss by upwards of 50%.

Boiler’s

you need an efficient boiler to lower your heating costs, and ideally you need a condensing boiler, as while they are more expensive to buy, according to the Energy Saving Trust, a condensing boiler could save you as much as £310 a year.

Ventilation Extractor Fans

are notoriously poor energy convertors and as such you must make sure you

Drafts

No matter how much preparation you do for the winter, your likely to find drafts that are leaking cold air into your home. It’s important you deal with these drafts using excluder strips and expanding foam fillers as it’s important that you keep these leaks to a minimum.

Rent Out Your Spare Bedroom

Should you have any spare rooms in your home, it is worth considering renting them out, think Airbnb.

Gas and Electricity

One of the best ways to save money is through your energy provider as there is a major difference between the different providers. Websites such as LookAfterMyBills.com keep an eye on energy prices and if needed will swap you a cheaper plan saving you money each month.

Telephone and Broadband

Websites such as uSwitch and Moneysupermarket compare prices of phone and broadband providers to help you choose the best plan for your needs.

Save Money On Entertainment

Go to Free Events

If you are looking to expand your horizons whilst saving money, make use of the many free fun and interesting events taking place near you. Check your local newspaper and Facebook groups to find out what is going on in your surrounding area. You will often find many interesting cultural affairs taking place that you may have never known or heard about. For example, a local band may be hosting an evening of Disney themed classics in your local park which would be fun for all of the family to go along and enjoy or you may find that a nearby museum is hosting a free art exhibition.

Eating Out

Eating out does not have to be expensive if you learn the right way to eat out. Across the interest there are numerous discounts and offers to be used, allowing you to choose what you want to eat that night.

- Restaurant Vouchers – Lots of restaurants these days run main course discounts, such as two for one offers, allowing you to save money by eating out. Website such as VoucherCodes, HotUKDeals and MyVoucherCodes are great websites to start.

- Discount Nights – Websites such as Opentable and Lastminute allow you to search for restaurants in your area that have deals on that night. The advantage of these websites is that you can also book your table through the site.

- Dining Clubs – such as Tastecard allow you join a club and use their card for a 50% discount at thousands of resultants across the country.

- BYOB – Generally it’s not the food that quickly racks up your bill to eat out, it’s the wine. This is where a “bring your own bottle” restaurant is the place to go for discounts. A bottle that cost 20 in a restaurant, probably only costs 5 in a shop. Note, some restaurants will charge a corkage fee.

- Avoid Bottle Water – we had a bottle of water last week, it cost 14. In my mind that’s a 14 waste as we could have drunk filtered water which was free. With some restaurants charging more than £8 for a bottle of water, if you go out for dinner twice a month, it will save you over £200 a year simply by switching to tap.

- Doggy Bag – We don’t seem to ask for a doggy bag of any leftover food in the UK, but across the rest of the world its very common. You have paid for it, and rather than it go in the bin, you can take your leftovers home and eat them the next day.

Final Thoughts

If you have been through the list and really cannot save any money each month, maybe it’s time to think about earning a little more each month. How about a side-Income, a second job, or even a hobby that can earn you money.

I agree with all the points mentioned above in the article. It is completely upon us how we manage the earning and save little by little.