Living abroad is a fantastic experience that I would highly recommend that you took advantage of if you’re ever offered, that said, it can affect your financial future if you’re not careful.

As soon as you leave the UK tax system, you’ll stop paying UK tax. This, in turn, means you’ll stop paying your National Insurance contributions, and therefore you have no state pension. Depending on your company, you could also find the contributions to your company pension stop, meaning that you’re on your own.

Benefits

This may all sound terrible, but there are a few financial benefits to you for being an expat, that you need to be aware of and possibly take advantage of depending on your financial situation.

The most prominent is what to do with your UK pensions that you’ve being paying into over the last few years. In short, you have three options;

- Leave it Alone – This is a real possibility if you have a gold plated defined benefit scheme guaranteeing your monthly pension for the rest of your life

- Transfer to a SIPP (Self Invested Pension Scheme) – A UK domiciled pension scheme recognised by HMRC and regulated by the FCA

- Transfer to a Qualifying Recognised Overseas Pension Scheme – An Overseas, tax-free or tax limited, domiciled pension scheme

Leaving your pensions where they are is generally not an option unless you have a gold-plated defined benefit scheme where the pay-out is guaranteed for the rest of your life. In this situation, you need to be very careful when you weigh up the effectiveness of transferring your pension overseas.

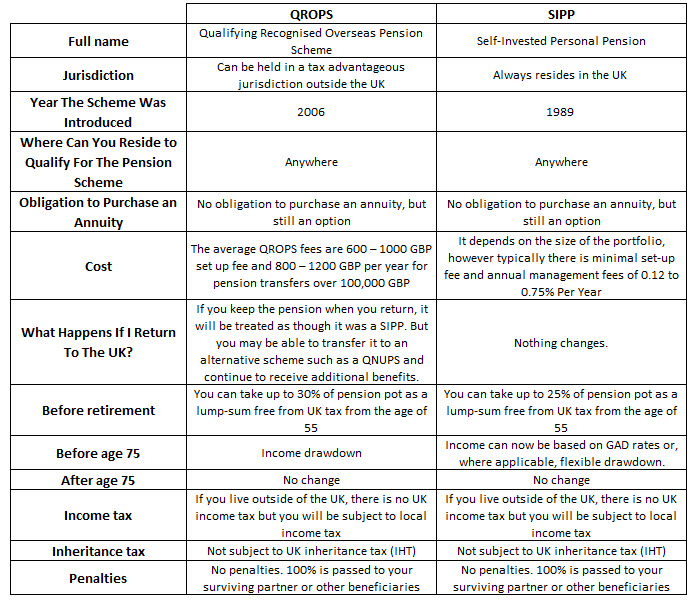

The Differences between QROPS and SIPPS

Below we’ve tried to look at both the SIPPS and the QROPS to understand their effectiveness. One point, you need to take this seriously and understand the implications of transferring your pension before you make a decision – Remember, your financial future is at stake.

The key difference between a QROPS and a SIPP is where your money is being held, and the pension scheme domiciled;

- QROPS stands for Qualifying Recognised Overseas Pension Scheme. As the name suggests, it’s a financial institution that is recognised by HMRC to allow it to receive funds from a UK pension. The key point, the financial institution is outside of the UK and the EEA and usually in a tax-reduced environment such as Malta, Gibraltar or the Isle of Man.

- SIPP stands for Self-Invested Pension Scheme and is basically the same as the QROPS above, but with the key difference being, your money is held in a Financial in the UK.

QROPS

QROPS stands for a Qualifying Recognised Overseas Pension Scheme. It was initially developed to allow expats who had left the UK and now resided in another country, a way to transfer their UK pension to their new country of residence.

Like many great financial schemes, advisers have worked out a way to abuse the scheme and transfer pensions to countries with no connections to the individual, to avoid paying UK tax.

Pros of QROPS

- You can potentially amalgamate all of your accumulated pension monies into one large pension fund, providing you with the ability to benefit from increased investment opportunities and fund discounts.

- From the age of 55 onwards, you can access a 25% tax-free lump sum, which could stretch to as much as 30% of your total pension pot, subject to the pension rules in the jurisdiction within which you live and the investment choices that you have made within your QROPS.

- QROPS offer the flexibility to invest in various currencies, including USD, EUR and GBP. This can be of particular benefit when you are able to receive your pension payments in your local currency, without it being subject to currency exchange fluctuations.

- UK residents and those who have lived and paid tax in the UK can use QROPS for Lifetime Allowance planning (LTA.) The LTA is a cap set for the maximum accumulated pension benefits which one individual can hold throughout their lifetime, without being subject to tax charges. The LTA is currently set at £1,055,000 GBP and any income taken from pension funds in excess of this figure will be taxed at 25%, and lump sums, 55%.

- As a transfer from a pension scheme into QROPS is classed as a Benefit Crystallisation Event, your pension funds are able to grow without the fear of being tested against the LTA and being subjected to tax charges.

Cons of QROPS

While the UK is unlikely to impose taxes on your QROPS, the country you are moving to may charge you.

- QROPS in Malta – usually pay a 30% tax-free lump sum with the remainder subject to Maltese income tax up to 35%.

- QROPS in Gibraltar – usually pay a 30% tax-free lump sum with the remainder subject to Gibraltar income tax at 2.5%.

- QROPS in the Isle of Man – usually pay a 30% tax-free lump sum with the remainder subject to Isle of Man income tax at 20%.

In 2017 new legislation allowed for a 25% tax upon transfer, levied at source by the UK trustee, unless either the individual and the QROPS are in the same jurisdiction or the individual’s employer participates in the same QROPS scheme. If your transfer fulfils one of these requirements, you are exempt from paying tax on the transfer. Otherwise, you will have to pay up to a 25% tax charge.

You, along with the QROPS provider with which you hold your money, are expected to report any residential or financial variations in your circumstances to HMRC for a period of up to 10 years after the implementation of your QROPS.

QROPS is not UK regulated, which means that as an expat, it will be difficult for you to voice any complaints you may have regarding the advice that you have received to a governing regulatory body.

Self-invested personal pension (SIPP)

SIPPs are UK-registered private pension schemes that are funded by an individual and follow UK legislation concerning tax and how and when they can be accessed. Because an individual funds them, there is no guaranteed income at retirement, the more you invest, the larger your pension pot, and in turn, the larger the income you will have.

SIPP’s have increased in popularity over the last couple of years due to their low cost and ease of use. They also offer a wide range of invests to be held within, however, SIPP’s are UK based which will limit the attraction if you are living abroad.

Pro’s of SIPP’s

- Cheap, flexible and full access to define your contribution their investment contributions

- Tax relief on contributions and 25% tax-free lump sum at retirement

- More Secure – the FSCS and FCA protect SIPPs.

- Allows you to decide when to take your pension over the age of 55

- Easier – to set up, run over time and consolidate your existing UK pensions

Con’s SIPP’s

- Pension contribution received tax-relief of at least 20% for the first five tax years of your non-UK residence and to a cap of £3,600 per annum

- Can be higher risk than a standard pension if you’re not an experienced investor

Should I Transfer my UK pension?

As well as understanding what SIPPs and QROPS are, you must understand the benefits of the type of scheme you currently have. In the UK, there are two key types of pension schemes – defined contribution and defined benefit.

- Defined Contribution schemes – are pension schemes where your own contributions and your employer’s contributions are both invested, and the proceeds used to buy an annuity at retirement. Typically, your monthly pension will be based on the amount you’ve paid in overtime.

- Defined Benefit schemes – are colloquially known as “gold-plated pensions provide you with a pension that is guaranteed for your life. This type of pension was widespread in the 1980s, however, due to their cost, they are scarce these days. You need to be very careful before you start trying to transfer a defined benefit pension and by law, speak to an adviser qualified to provide UK pension advice.

The Final Option – QNUPS

QNUPS stands for Qualifying Non-UK Pension Schemes and is most suited either individuals between the ages of 55 and 75 looking for an international pension scheme or for those who have reached their maximum income tax relievable pension contributions in the UK.

The most significant advantage QNUPS offer is that there are no restrictions on where you live; though how much tax you pay on your withdrawn pension income will depend on your country of residence, with some countries charging more than others.

Pro’s of QNUPS

- You are exempt from UK inheritance tax (IHT), meaning your family and friends inherit a lot more of your wealth.

- At the moment, there are no limits on contributions. Be careful, however. It may not last. The authorities are always looking at ways to charge offshore schemes. As a safety measure, experts suggest that you restrict your contributions to around 50% of your net worth.

- While many plans will only allow you to invest up to the age of 75, QNUPS has no official age limit. We use the term ‘official’ as it can depend on the country in which you reside, so be sure always to check first.

- A more concrete advantage of a QNUPS is that it has no upper limit on fund size. You can contribute as much money into your plan as you like.

- You can transfer 100% of the QNUPS fund to your beneficiaries. This will probably be subject to charge depending what country you are transferring it from.

Con’s of QNUPS

- Once you start looking into QNUPS, you will start seeing that you can never be quite sure about the regulations surrounding them. There are so many grey areas, particularly around tax treatment, that you will naturally worry about what will happen if this and this law slightly changed. Without a doubt, it is a risk.

- You will receive no UK tax relief on any of the amounts you invest.

- As these are often sold as inheritance tax protection vehicles, they have to be used carefully and advised on technically and adequately.

- Be careful with mis-sold QNUPS. People have been known to sell the lie that QNUPS are exempt from pension sharing rules on divorce. If you hear that move straight on. The best thing to do is to go into it with a complete understanding of what QNUPS entail.

Finally

Personally, I feel the most significant benefit of using a SIPP or a QROPS plan is being allowed to do what you want, with your money. If you transfer your pension to either a SIPP or a QROPS, you may be able to leave much more to your children when you die. Rather, than in the case of a defined benefits scheme where 50% of your income goes to your wife upon death, and nothing to your children, it could be possible to add your pension to their inheritance.

That all said, speaking to a qualified financial adviser is a must.

hi david-

very interesting article. Could i pick up on an important point you make though? The summary table suggests that, if you live outside the UK, there is no UK income tax to pay on income from either SIPPs and QROPs. I don’t know much about QROPS (hence the interest in your blog) but my understanding was that expats will still pay UK income tax on SIPP drawdowns (after the 25% tax free portion). could you comment please? thanks, paul

Hi Paul

Thank you for the comment. To clarify as it’s a little unclear on my table, if you’re in the UK you will benefit from the 25% tax free lump sum and any income that you withdraw in excess of your UK personal allowance will be subject to UK income tax. If you are an expat, it would be be advantageous from a tax perspective to transfer your SIPP to a QROPS.

Thanks,

David

The blogs give a good understanding of QROPS and SIPP with its pros and cons. It helps me to decide before transferring my pension.