For the average person in the UK today, the only way they’re going to save enough money to retire is by investing and growing their wealth. For me its even more important that I grow my wealth over the years. I don’t huge salary, nor was I provided support through University, and with a family to support, my savings are limited. What I do know is how to invest my money, and how to make it grow over time.

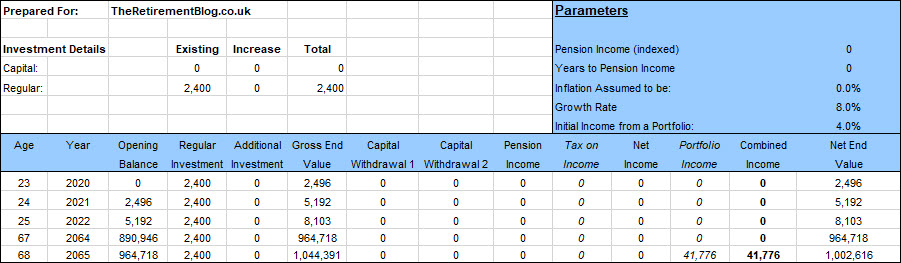

If you saved £200 per month, from the age of 23 to 68, (2049 is the year when I can retire and benefit from my state pension), you’d have a pension pot of £110,400. If you invested it, and it grew by a conservative 8% a year, you would have over a million pounds in your pension pot – £1,044,391 to be precise, If your like me, and want to retire earlier, I want to be done by the time I’m 50, the saving and compound interest, makes this possible.

Self-Investing

Why doesn’t everyone invest? Of the people that I have spoken to over the year, most people don’t invest their savings because they’re convinced they’re going to loose their money, they don’t know how to get started or they don’t know how to get started and don’t trust the advice their financial adviser has provided.

In this section we’re looking at how to invest and grow your wealth, but the important part of investing your savings, is to be able to do it yourself and pay as little fees as possible, especially in the early days. The difference between using a financial adviser and not can be a significant difference. In my experience, financial advisers rarely outperform the index’s, and there is a minimal point in using them when you can do it yourself by merely buying index funds or ETF’s.

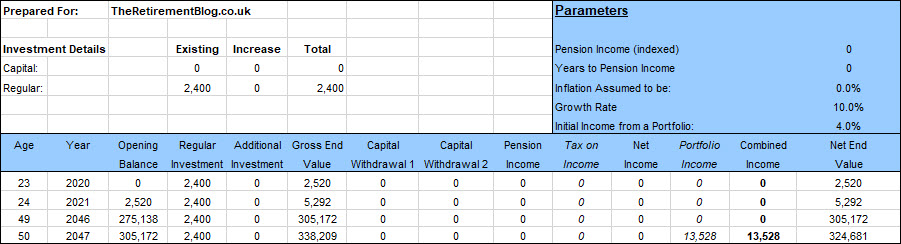

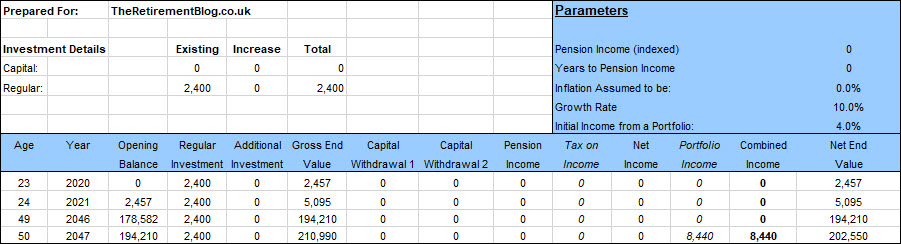

As an example, if we were trying to become a millionaire by the time we were 50 and invested £200 per month, from the age of 23 to 50 years old, you should have £338,209 in your bank account. If you’ve used a financial adviser and you’re paying 2.5% for the pleasure, that same investment would only grow to £343,104. The financial adviser would have cost you a massive £127,210 over the 27 years.

The Problem

I’m a massive fan of self-investing, and I believe it’s the best way of growing your money over time, especially in the early years. That said, you need to understand whether you’re capable of self-investing. Too often, I speak with people who’ve tried to follow the advice but found it too difficult to discipline themselves to save and invest over time. Typically, they follow this advice and self-invest but only do it for six to eight months of the year. Why? Because in the other months, they spend the money before they have time to invest it.

On the same token, because your money is freely open, you need to be disciplined enough to leave it growing over the years. Too often we meet with people who’ve started building their investment portfolio but have decided to take their growing pot and spend it. The effects of which can be seriously detrimental to your future.

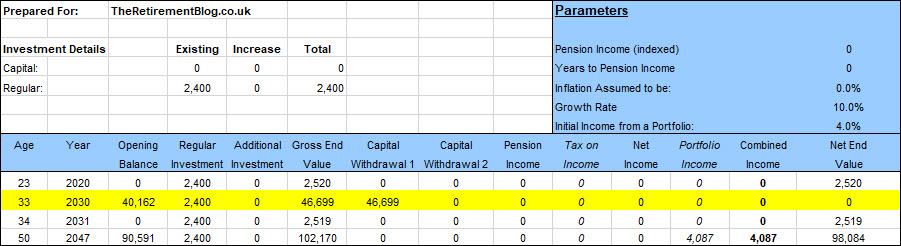

As an example, if you saved £200 per month between the age of 23 and 50 (i.e. 27 years), with compound interest and an interest rate of 10%, you’d end up with £338,209 by your 50 birthday. If aged 33, you decided you wanted to liquidate your retirement portfolio, you’d be able to take out £46,699. However, with your portfolio now starting at zero, the £200 per month that you were investing will now only become £102,170 by the time your 50.

What Risk Level Am I Prepared To Take?

Risk tolerance depends on your investing time horizon and when you need the money back. If you need the money back in the next three years, you cannot afford to take chances with your money. If it’s not there because you have invested in emerging market equities and they have dropped in price, your retirement is at stake.

If you’re starting out saving for your retirement, you should be looking at portfolio growth, and this means taking a risk. You should be looking at the equities market, especially across emerging markets such as Asia or Africa.

It’s also acceptable to put money into the latest IPO, knowing that if it doesn’t perform right from the outset, you have time on your side to wait for it to perform, and growth on your money.

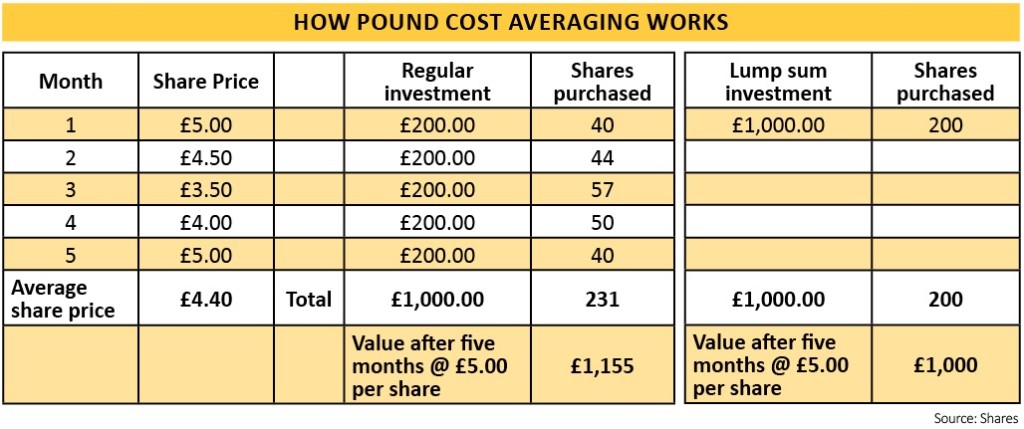

Pound-Cost Averaging

Market timing is everything. The idea with shares is to buy low and sell high. The problem, I don’t have a crystal ball, and I cannot predict when the markets are going to rise or fall. If you cannot predict when the markets are going rise, basically you have no chance of ever making money on the stock market – or do you?

Actually, you do, and you do this by Pound-Cost Averaging. The idea behind is that you buy a fixed amount of a specific investment each, and every month. It doesn’t matter if the stock-market goes up, or down, you keep buying every month. Effectively we’re accumulating shares in a specific position over time, with the idea that at some point in the future, we can sell those multiple positions for more than we paid for them.

As an Example

Each month, I buy £500’s of SPDR FTSE UK All Share UCITS ETF into an ISA. I buy this every month whether the market is up or down. At the time of writing, it cost £52.28 per share, meaning that for my £500, this month, I bought ten Shares. The point is, I have been buying shares since May 2015 when the share price was around £40 per share, however for a few months in 2016, in dropped to around £35 per share.

With pound cost average, you need not let this phase you. All in means is my £500 per month, was buying six-teen shares, rather than the current ten shares. Since 2015, I’ve accumulated over 600 shares, and due to pound-cost averaging, I’ve managed to time the market perfectly with a 30% return that I would not have been able to achieve if I had tried to time the market.

Broker Fees

Your broker is the person that will be buying the shares on your behalf. They will charge a commission, however, it’s essential, especially in the early stages of investing, that you minimize this commission.

As an example, let’s imagine that you’re buying £ 100’s per month of the SPDR FTSE ETF that I buy each month. Your broker is likely to charge you £7.50 of this transaction. This means you need growth of a massive 7.5% just to cover your transaction costs.

Realistically, the minimum size for a transaction that will cost £7.50 is £500 or 1.5%, however, this can be reduced further if you increase the amount, or only buy shares ever two/three months.

How To Invest

The first point to make clear, you don’t need the help of a financial adviser to grow your money. It’s possible to invest, and grow your money, yourself through a self-invest platform. Your first point of call is the set yourself up an ISA. In the UK, if you’re over the age of 18, you have a £20,000 annual ISA allowance. By investing in an ISA, you will not have the pay any tax on the stock-market gain that you make.

Currently, there are two types of ISA’s, Cash ISA’s and Share ISA’s, however, to grow your money, you want to invest in Stocks and Share’s ISA’s as cash ISA’s will not provide you more than 1.5% growth.

In the UK you have a selection of options to set up an ISA, my favourite is with Hargreaves Lansdown who are a leading savings and investment platform based in the UK. They have built up a good reputation for their 1.2 million clients and currently look after over £100 Billion in savings and investments.

The HL.co.uk ISA is my favourite way to invest money. The ISA cost’s just 0.45% each year, while allowing you to access over 2,500 funds, shares and investment trusts, or access one of six pre-built funds through the H&L platform. If you’re buying into funds, there is no dealing charge.

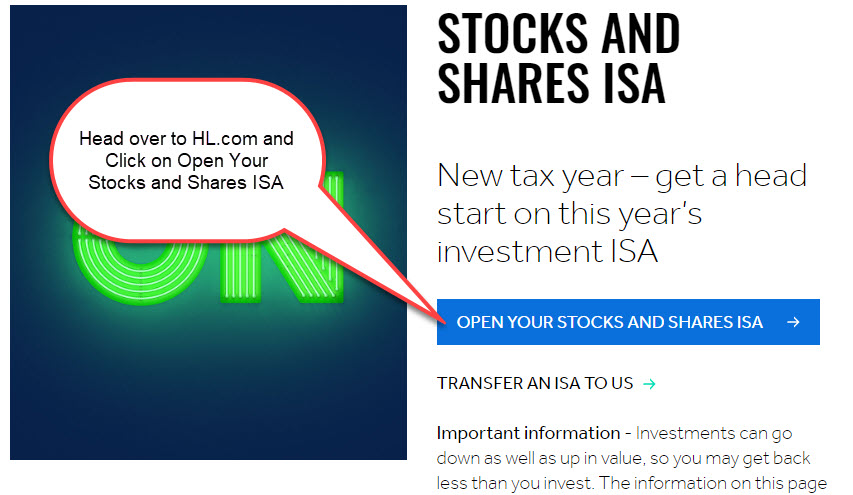

How To Set Up An ISA

To set up your Stocks and Shares ISA, head over to HL.co.uk and click on the “open your stocks and Shares ISA” as shown above. The process from start to finish take less than five minutes to get you account up and running. To fund it, you can just use your debit card and your national insurance number.

The platform allows you set up a monthly direct-debit. I would highly recommend that you did this as will take money directly out of you account and into your ISA before you’ve had a chance to spend it.

Final Thoughts

The best thing about investing through an ISA, its Tax free. You can buy and sell as much as you want and there is no tax liability. The problem though, you can only invest £20,000 per tax year into your ISA. If you’ve built further wealth that extends above this limit, you need think further about your investments and whats best to grow your wealth.

Remember one thing, its very possible to invest and make money on the stockmarket, but no matter how clever you think you are, You can’t outsmart the market.

David is a financial expert & learn here how to grow your money. Thanks

Enjoyed reading this! Now heading to HL to open an ISA account. Thanks

Thank you, any questions, I’m here to help