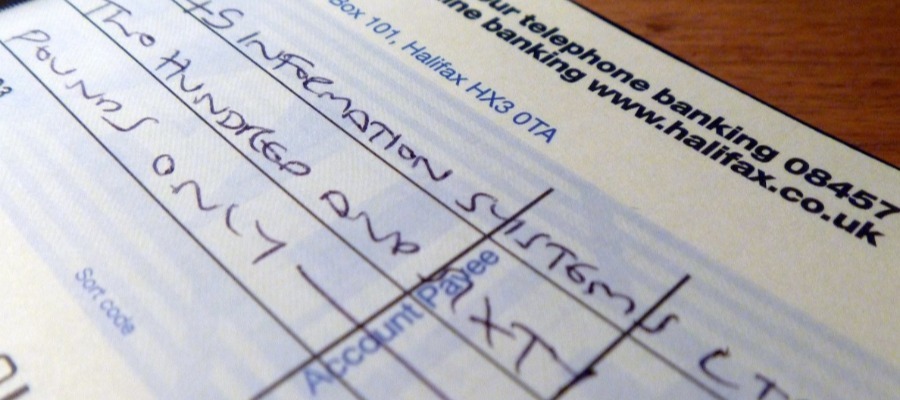

We’ve talked in the past about cheque’s and what is the appropriate way to write a cheque so that you don’t have a problem when it comes to paying in a cheque. The most important part of the writing cheque process is your signature, which in the UK today, is the number one reason for cheque’s bouncing.

One of the questions I have been asked a few times recently is how long cheques are valid for and what happens if you have a cheque that has expired.

How Long are Cheque’s Valid for?

In the UK today, it’s common practice for a bank to stop accepting a cheque that is older than six months. That does not mean cheque is only valid for six months; it merely means that banks will not accept it after this period. In truth, a cheque is valid for as long as there is a debt between two parties. In real terms, cheque’s do not have an expiry date.

What Happens If You Have An Expired Cheque?

The obvious question next, what happens if you have a cheque that is older than six months, that you’ve not paid in, either because you’d misplaced it or even because you’d forgotten to pay it in. In all honesty, the easiest way to get a solution is to ask the person who gave the cheque in the first place to provide you with a new cheque.

If you cannot get a new cheque written, you do have another route, however, it gets complicated and potentially expensive, very quickly. If you cannot get another cheque, you’ll need to take your case to court where you can prove that debt is owed to you and the owner of that debt needs to pay you. Remember this can be expensive and as a result, if it’s only a small amount of money, its probably not worth the costs to go to court.

How Can You Avoid Cheque’s Expiring?

The biggest problem with cheque’s expiring is that its wasted money that you could be putting towards something else. If you’re running a business, it could be the difference between staying afloat and not.

Below are three things you can do to help you avoid that annoying problem when cheques expire.

- Timing: Set up a weekly time when you take all cheque’s to the bank and pay them in. It’s a good idea to pay cheques into the bank as soon as possible. This way you will not forget them, and whether it’s one cheque or ten cheques, each week you’ll pay them into the bank.

- Delay: Sometimes it’s not possible to pay a cheque into the bank immediately as it’s a dated cheque, in this case, it’s vital that you have a system set up in weeks where you store your cheques that need to be paid. This way, if you now a cheque can be paid in two weeks, you can sore it with all the other cheques that can be paid into the bank that week.

- Alternative: If at all possible, try to be paid in a different way other than a cheque. In the world we live in, it’s very easy to be paid by bank transfer, direct debit or even through an online method such as PayPal.

Final Thoughts

Cheque’s are a dying breed. In twenty years, there will be no such thing as a cheque, and therefore this is something we only need to think about for a little while longer. Remember one point with cheques, even if you have paid cash into your account, a cheque that you have written could still bounce. This is because of the way that money clears into your account.

Generally, if you pay cash into your account, it will not clear until 23:59 that same day and therefore will not be available for spending until the following day. If you have written a cheque that same, it will most like bounce as there is no cash in your account.