The hardest part of actually saving for your retirement, is saving money. We all understand and appreciate that there are many unavoidable costs that add up, but the problem is that these costs often whittling away your monthly income in a blink of an eye. The typical life and savings cycle for most people across the UK starts with leaving school and finding your first job. It often involves long hours and low pay, resulting in you struggling to save what little income you receive and what you do, you want to enjoy.

As you progress through the decades your priorities change with your twenties typically focusing on to trying to save a deposit for a house, your thirties paying for children, your forties on your children and home, and then when you enter your fifties, you start thinking about retirement.

The Problem

The problem with mentality, is that by the time you reach your 50’s, your earning potential starts to reduce, but your saving requirement needs to be high. It’s incredibly difficult to build a decent sized pension pot to retire in fifteen years, especially if you lose your job in your mid-fifties and struggle to find another.

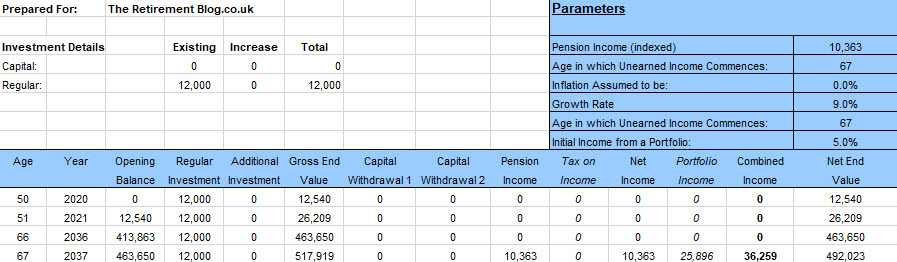

As an example, the above table shows your savings needed to retire aged 67 with a £35,000 Gross Income per year when you have no savings at age 50. Effectively the table shows that you’d need to be saving £1,000 per month, for 17 years. It would need to grow by 9% per year after charges. If you achieved all this, at the end of 2036, you have a pension pot allowing you to take £25,896 per year and a state pension of £10,363 (current state pension factoring in the consumer price index in 2037) giving you a total Gross Income of £36,359.

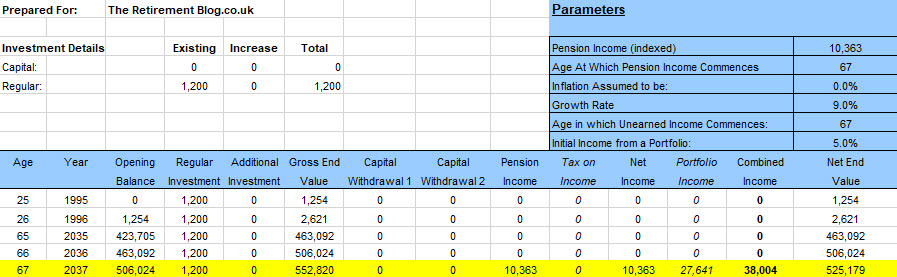

It is imperative that you save money throughout your working life. It will make it much easier to save for retirement if you do it over the long term. The below table shows saving £100 per month from the age of 25 to the current retirement age of 67 (End of 67th year). If you saved just £100 per month, for the full 42 year period, and it grew by 9% each year, it would give you a portfolio income of £25,301. This together with your £10,363 (current state pension factoring in the consumer price index in 2037) from your state pension would give you a total Gross Income of £35,664.

Saving over the long term is much easier. Below are seven tactics to trick yourself into saving on a regular basis.

Set up a Standing Order

Setting up a standing order is an easy procedure which once set up, requires no further action from you (unless you later decide to increase your savings amount!). It is best practice to have your standing order date set around the time that you are paid each month.

By doing so, you are reinforcing the classic “out of sight, out of mind” mentality ensuring that you will not miss the sum that is automatically deducted from your account on a monthly basis. You will soon adjust to your new monthly income and will feel that you have won a windfall when in time you check the balance of your savings account.

Remember, its the small things that count. In the table above, we clearly show that saving just £100 per month, between the age of 25 and 67 equates to a portfolio over £550,000 and a Gross portfolio Income of £27,641.

Correspondence

When setting up your savings account(s)/pension, it is a good idea to ask the provider to have all of your statements and correspondence set up to be accessed solely online with an email prompt.

While you may not completely forget about the account, it should soon lose the status it would hold if you were receiving monthly correspondence in the post.

Name Your Account

A little psychological trick you can use is to give your account an important name. For example, you might be more motivated to pay into an account that you label “My Dream Retirement in Australia.”

If you tell your friends about the account name, and the name is memorable enough, they are likely to ask you about it, which will motivate you even more.

Download an Application (App)

Today you can download all sorts of apps that help you save money. They have various helpful features such as countdown timers and budgeting sheets to inspire and help you to save.

You can even download money saving apps that help you to save for specific things such as holidays and pensions. There are a selection of both paid and free apps here, but my favourite is a financial management tool call Emma. Emma allows you to manage your money all in one place. The app helps you to avoid overdrafts, cancel wasteful subscriptions, track debt and save money.

Make it Into a Competition

Perhaps you have a friend who is saving for something in particular. Possibly you are both saving for the same thing. Either way, you can compete against each other to see who can save and earn the most in returns.

Give up a Habit

If you have a habit, such as smoking, and you have been wanting to give it up, you could take this as your opportunity. Give up the habit and redirect the money that you would be spending into a savings account.

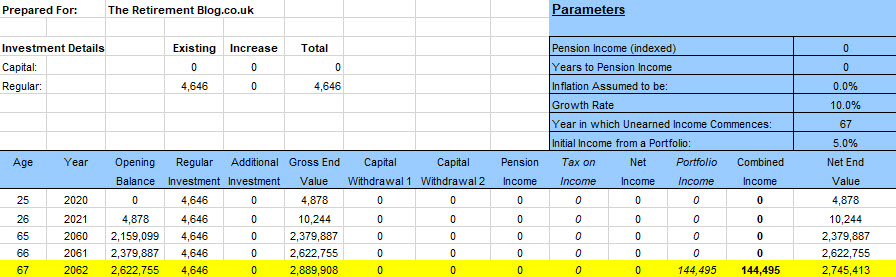

Smoking in the UK is especially expensive and can be the difference between retiring and not. Currently the price of a packet of cigarettes in the UK on average is £12.73. This means for your typical pack-a-day habit, it’s costing you £4,646.45. If you take this further and work it out in terms of your retirement, the figures get scary, very quickly.

The table above shows the cost of smoking a packet of cigarettes each day at current prices, between the ages of 25 and 67. If you smoke, it would cost you £4,646 per year. If you don’t smoke, and instead invested that money (the price of a packet of cigarettes at today’s cost) into a savings plan that grew by 10% each year, you’d have £2,745,413 in your savings account. This could provide you with a Gross pension income of £144,495 per year, using the 5% rule.

Daily Change

The idea here is at the end of everyday, you empty your pockets into a jar and save this money. If you’re anything like me, you’ll be amazed at how much you save over the course of a month, and year.

Save Your Raised

If you’re luckily enough to get a pay rise, pretend that you didn’t get one and carry on as normal. The same can be applied to any other unexpected money that you receive from a bonus to a tax refund.

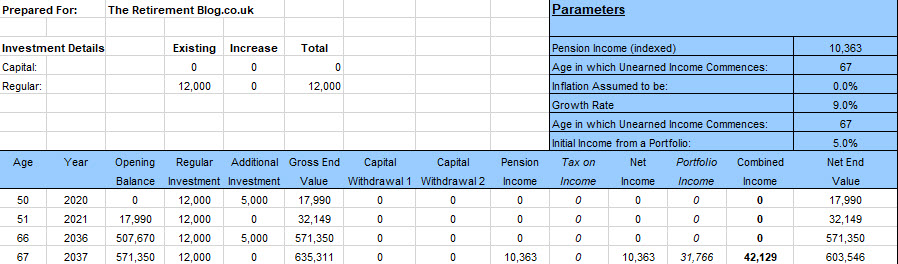

For most people, as soon as they get a bonus, they start working out what to spend it on and most of the time its going on “wants”, rather than “needs”. While its important to treat yourself every know and again, it’s important to realise the effects of adding lump-sums into your savings account. In the above example, we saw how saving £1,000 per month for 17 years would give you total Gross Income of £36,359. If you saved your bonus every two years and saved £5,000 extra into your saving account, that £36,359 would increase to £42,129

Keep The Change

These type of apps work in a way that they add your purchases up to the nearest pound save the change in separate account. In the UK my favourite of these is called Tandem. It works by linking itself to your current account using Open Banking which is a system that allows banks and apps to share your financial information securely.

Your saved spending will be moved into a savings account that pays 0.5% interest. While this is not a lot of interest, you can withdraw your funds at anytime allowing you to transfer your savings into a saving account each month. Most importantly, its safe, up to £85,000 is covered by the Financial Services Compensation Scheme (FSCS) meaning that you could transfer your saving yearly, if you’re worried about spending it.