Choosing a financial adviser is a decision that should not be taken lightly. The difference between a good and a bad financial adviser can easily be hundreds of thousands of pounds.

The two tables below show the difference between investing £200 per month with the help of a Financial Adviser costing you 2.5% per year and investing £200 per month by self investing and for this example, paying no fees. In both tables the time scale is 32 years and the growth rate is 10%

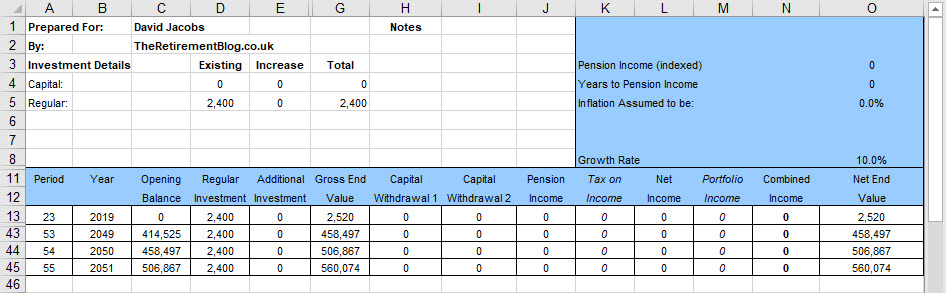

No Fee’s – Self Investing

The below table shows that investing £200 per month from the age of 23 to 55 results in a pension pot of £560,074. Using the 4% rule, you could easily take out £22,402 each year in Gross pension income.

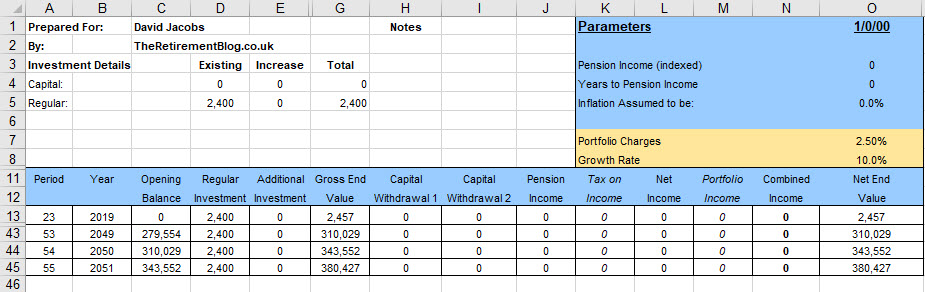

2.5% Fee’s – Investing Through a Financial Adviser

The below table is very similar to the above. The only difference, in this example, we’re using a financial adviser and in this example its costing 2.5% per year. The interest rate is the same 10%, but the total pension pot over the 32 years totals £380,427. Again using the 4% rule, this would equate to £15,217.

This is a massive difference. The 2.5% cost of using a Financial Adviser has cost you £179,647 in pension pot, or £7,131 in Gross Income. If you’re going to use a financial adviser, you better make sure you you choose the right one.

Questions To Ask Your Financial Adviser

We’ve shown you the difference in pension pot amounts using a financial adviser and I’m sure you now understand the importance of choosing a good financial adviser, but how do you go about this.

Over the years we’ve heard of many people getting swindled out of thousands by an unqualified adviser. The problem is that most people have little financial knowledge and have absolute trust in their financial adviser to protect their financial future. Below are ten questions to ask your financial adviser at your first meeting. Make sure you’re happy with the responses before you sign over your financial future.

Are You a Registered Independent Financial Adviser?

To practice as a Financial Adviser in the UK, you must be registered with the Financial Conduct Authority (FCA). You can check the FCA’s online register for any adviser throughout the UK to ensure that they are regulated to give advice.

You may also wish to confirm that your adviser is an Independent Financial Adviser (IFA) as opposed to a Restricted Adviser that is tied to product providers and their range of products.

IFA’s, also known as “whole of market” advisers, provide tailored advice based on their unbiased research across the entirety of the financial market to source the best products/investments that are available.

What Qualifications Do You Hold?

IFA’s in the UK must hold a minimum Level 4 Diploma in Financial Planning certificate which they will have acquired through an institution approved by the FCA, for example, The Chartered Insurers Institute (CII).

Also, your IFA will need to display their Statement of Professional Standing certificate. This is a certificate issued by the FCA affirming the legitimacy of your qualifications and registration with the FCA.

What Do You Think Of My Financial Situation?

The first thing any financial adviser should examine is your current financial situation and re-examine your investment goals, time horizon, risk tolerance and where these might have changed since your last meeting.

Once this is complete, it’s a great idea to ask the financial advisor what they think of your financial situation as this will give you a good indication of the type of financial adviser that you’re speaking with. Over the years, I have met a few financial advisers either one of two things happens, either they dive right in trying to get you to invest more for the future, or they sit back and really understand whether your current investments will meet your future financial needs.

As an example, if you look at my current financial situation, you can clearly see that I’m on target to meet my financial goals. While I think it’s important that I carry on investing into the stockmarket, I’m not going to increase from my currently levels even though I have the ability to do so. If I met with a financial adviser today, and they told me to invest more in the stockmarket, I would come to the conclusion that they were a salesman rather than a true Financial Adviser.

Tell Me About Your Experience and Your Area of Specialty?

Financial planning can be a very complex field requiring vast knowledge across many different areas for which IFA’s are required to have a level of knowledge and suitable qualifications to advise upon.

Similar to many professions, IFA’s may opt to specialise in a specific area(s), for example, retirement or inheritance tax (IHT) planning. It is essential to understand your IFA’s experience and any areas of specialty and how they relay to your personal requirements. Most advisers would be delighted to advise you on your affairs and refer you to a trusted specialist for critical areas of financial planning, should one be required.

What Is Your Fee and Service Structure?

In your first client meeting, your adviser will provide you with a Client Agreement for reading and signature, should you decide to proceed with advice. The agreement will outline various details including the services on offer and the applicable fees, both initial and ongoing, pending on the service which you require.

You need to make sure you understand the fee’s involved for the entire lifespan of the product. Remember, the adviser fee’s can decimate your savings over time.

How Will Our Relationship Work, Especially Over the Longer Term?

What we’re trying to understand here is twofold, firstly how much access you’re going to have to the adviser, and what happens when they retire or perhaps change profession.

Over the years, we have met many people who’ve signed up with one advisor, only for that adviser to either pass them off to a junior admin officer or for the advisor to change career paths and never to be seen again. Remember, financial advice is only as good as the laws that support it. If the inheritance tax laws change for example, the information on how to protect your assets will also change. You need to be able to speak with your financial advisor to makes these changes.

Are You A Truly Independent Adviser?

Across the market the are independent financial advisers (IFA’s) and then there are truly independent financial advisers. The difference between the two comes down the products and plans they can offer.

The first will typically have a range of products and plans from the top global names in financial and investment planning. These plans generally are structured plans with very little flexibility and carry hefty penalties for early exists, which is bad news if you’re anything like me and have no real clue of how life is going to turn out.

The latter is a truly independent advisor, not only will they have ridged plans and products for those that need help disciplining themselves to save money, but they also have products that don’t tie you into the long term and is totally flexible.

What Do To Ensure My Money Is Secure?

This question is double-edged. Firstly I’m asking about the security of my money, and secondly, we’re talking about the adviser’s investment philosophy. How does he/she protect assets in a recession?

In the UK, The Financial Services Compensation Scheme (FSCS) covers regulation for both banks, building societies and investment accounts. If your investments are held within one of these three platforms and it goes bankrupt, the FSCS with pay compensation for up to £85,000 per person, per bank.

What’s Your Investment Philosophy?

This line of questioning not only discusses how the adviser invests money into the market, but also should start a conversation about risk and reward and your time horizons. I’m a firm believer that you should be taking risk in the early the part of your saving time horizon and reducing that risk as you get closer to your time horizon where you need the money back. You’d be amazed at how many advisors that I’ve met over the last few years that have little or no investment philosophy.

Investment philosophy should also cover their investing approach and whether they are actively involved in the customisation of portfolios. Financial advisors will often customise a portfolio based on their client’s needs and time horizons. As I mentioned above, I’m a firm believer that you should be taking risk in the early the part of your saving time horizon and reducing that risk as you get closer to your time horizon. As a result, if you’re at the start of your investment, you’re going to have a very different portfolio than someone who is at the end of their investment time horizon.

Diversification should be another conversation that you’re having with your adviser when you start to talk about investment philosophy. A fully diversified portfolio should not just include FTSE100 companies but should consist of both mature and emerging markets across the range of small, mid and large-cap stocks. I would also be looking for portfolios to contain bonds, property, and commodity listings.

The final line of questioning around a financial advisor’s investment philosophy is how they measure their performance. Too often, I meet people whose financial advisers judge themselves by the market. For example, they will base their performance on the FTSE 100.

If the FTSE 100 goes up by 10% and they return 12% the client, they’ve done well. The problem, they’ve also done well if the FTSE loses 30.9% as in the recession of 2008, but they’ve only lost 20%. The problem with this attitude, you’ve still lost 20%, and you’ll still need a 25% return to recover your money. If you’ve already started withdrawing money from your portfolio, the damage could be much worse.

What’s Your Target Rate of Return

This is a great question that shows the difference between advisors and salesman. Salesmen will tell you that you can achieve 12% per annum. They base this on the average annual return from 1923 (the year of the S&P’s inception) through 2016 which is 12.25% (Dividends Included) or the average return of the FTSE All-Share from 1962 to 2018 which is just over 11%.

The real problem is the majority of people are not going to have a time horizon (i.e. when they want their money back) of nearly 100 years. For the majority who are reading this blog, at best it’s 30-40 years and probably a lot shorter. If we took 15 year period from 2005 until 2020, the FTSE 100 has returned an average of 4.3% per year, the Dow has returned 12.3% and my favourite Emerging Markets ETF the iShares MSCI Emerging Markets ETF has returned an average of 10.1%.

Am I Still on Track to Meet My Time Horizon?

Should I have multiple time horizons for different financial goals? Life changes all the time, and those changes can impact your financial plan. Maybe it’s time to start saving for your kids’ college. Maybe your aging parents had recent health issues and you want to be prepared to help. Maybe you’re well beyond investing 15% of your income in retirement accounts and you want to get into real estate investing. As your finances shift with time, you need to discuss these changes with your adviser.

Finally

As a final question to a new financial advisor, I would also be asking them where their money is invested and how they go about protecting their assets. I want an advisor who practices what they preach. I would also ask for proof. If the advisor starts talking about their investment products that they’ve been using to build their retirement fund, ask to see a statement. Any advisor who is not willing to show you where they keep their money probably has something to hide and would not be my first choice of a financial advisor.

Most importantly, remember, there are a lot of financial advisers across the market. You’re likely going to be speaking with this person a lot of the next few years, and therefore you must choose wisely.